181 result(s) for retail tax

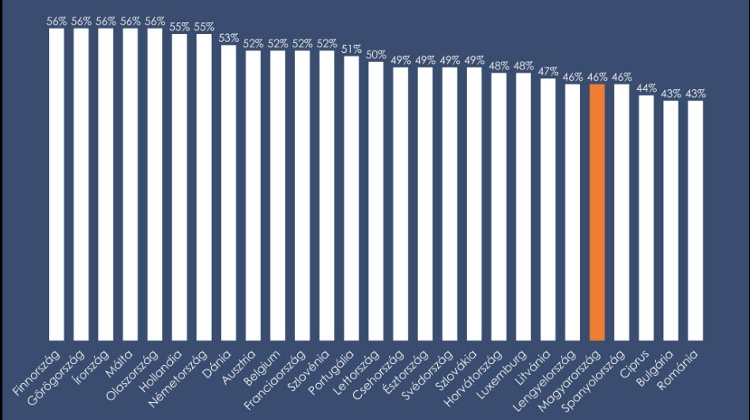

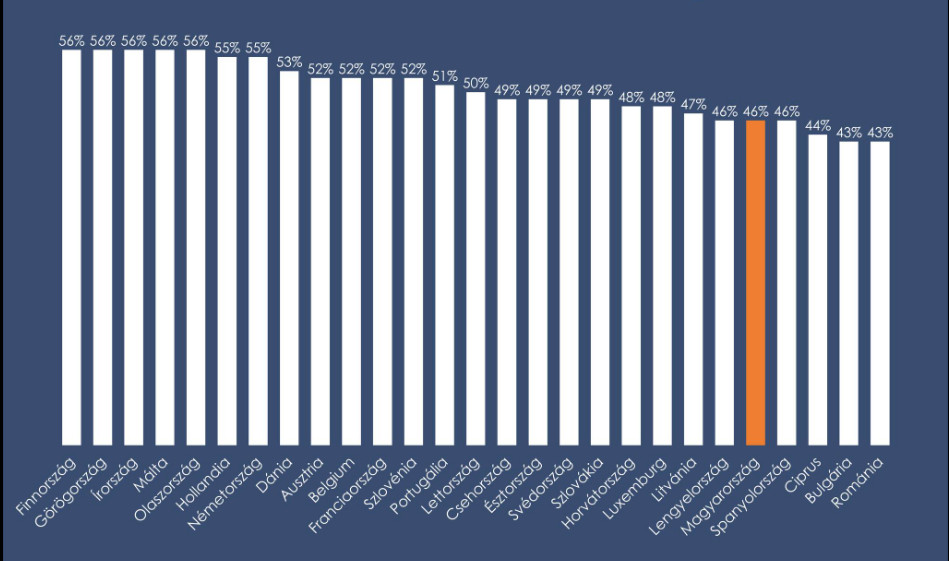

Surprisingly 46% Tax Included in Regular Petrol Price in Hungary is Actually Lower Than in Many EU Countries

- 23 Apr 2024 2:20 PM

- hungarymatters.hu

- finance

Hungary’s taxes are not to blame for high fuel prices, the finance minister said on Monday, adding that taxes on fuels were among the lowest in the European Union.

“Soft Protectionist”: Tougher Regulations Coming to Hungarian Food Industry

- 15 Apr 2024 2:27 PM

- http://hungarytoday.hu/

- food & drink

The government’s 2030 Competitiveness Strategy promises “soft protectionist” measures to protect domestic food companies. This also means that the authorities will take stronger action to protect Hungarian suppliers, reports Világgazdaság.

EC Investigation Starts After Spar Claims Special Retail Tax in Hungary Discriminates Against Foreign Companies

- 8 Apr 2024 5:49 AM

- hungarymatters.hu

- business

The European Commission is conducting an investigation into the Hungarian retail tax after the Austrian government and retail chain Spar filed a complaint against it, the EU authority told Reuters.

Hungarian Weeklies on Spar Food Store Chain's War With Government

- 27 Mar 2024 6:59 AM

- http://www.budapost.eu

- current affairs

Opinions diverge on the conflict between the Dutch-based food retail chain and the Hungarian government.

SPAR’s “Attacks” Against Gov't Driven by “Loss-Making Position” of its Local Business

- 19 Mar 2024 5:44 AM

- hungarymatters.hu

- finance

The national economy ministry called communication by the Austrian owner of SPAR supermarkets in Hungary on government measures to bring down inflation “malicious” and “false”.

Budapest Mayor's Refusal to Pay City's Taxes 'Unprecedented', Says Hungarian FM

- 22 Jan 2024 9:16 AM

- hungarymatters.hu

- current affairs

Finance Minister Mihály Varga, in an interview with the online edition of business daily Világgazdaság, said it was “unprecedented” that while Budapest residents and businesses meet their tax obligations, the city’s mayor “ignores them”.

MOL Fuel Price Hike in Hungary to Be Introduced in Two Phases

- 2 Jan 2024 12:52 PM

- http://www.hatc.hu

- shopping

MOL announced that it will implement an EU-mandated increase in the excise tax on fuel in two stages: raising prices by Ft 20 per litre on January 1, and by Ft 21 on January 15.

Blame Game: High Food Prices in Hungary Are Due to Government Windfall Taxes, Says Spar Boss

- 25 Sep 2023 12:35 PM

- http://www.hatc.hu

- shopping

Hungarian consumers have become very price-conscious in the current market environment and this is reflected in the growing market share of own-labelled products, Spar CEO Gabriella Heiszler told the annual conference of economists in Eger.

Asset Sale Helps Tesco Avoid Serious Loss in Hungary

- 31 Jul 2023 3:30 PM

- http://www.hatc.hu

- business

British-owned retailer Tesco realised Ft 723.3 billion in revenue last year, up 15.8%, as post-tax profit grew from Ft 12.9 billion to Ft 19.6 billion, lifted by the sale of assets, Portfolio writes.

Surprisingly 46% Tax Included in Regular Petrol Price in Hungary is Actually Lower Than in Many EU Countries

- 23 Apr 2024 2:20 PM

- hungarymatters.hu

- finance

Hungary’s taxes are not to blame for high fuel prices, the finance minister said on Monday, adding that taxes on fuels were among the lowest in the European Union.

“Soft Protectionist”: Tougher Regulations Coming to Hungarian Food Industry

- 15 Apr 2024 2:27 PM

- http://hungarytoday.hu/

- food & drink

The government’s 2030 Competitiveness Strategy promises “soft protectionist” measures to protect domestic food companies. This also means that the authorities will take stronger action to protect Hungarian suppliers, reports Világgazdaság.

EC Investigation Starts After Spar Claims Special Retail Tax in Hungary Discriminates Against Foreign Companies

- 8 Apr 2024 5:49 AM

- hungarymatters.hu

- business

The European Commission is conducting an investigation into the Hungarian retail tax after the Austrian government and retail chain Spar filed a complaint against it, the EU authority told Reuters.

Hungarian Weeklies on Spar Food Store Chain's War With Government

- 27 Mar 2024 6:59 AM

- http://www.budapost.eu

- current affairs

Opinions diverge on the conflict between the Dutch-based food retail chain and the Hungarian government.

SPAR’s “Attacks” Against Gov't Driven by “Loss-Making Position” of its Local Business

- 19 Mar 2024 5:44 AM

- hungarymatters.hu

- finance

The national economy ministry called communication by the Austrian owner of SPAR supermarkets in Hungary on government measures to bring down inflation “malicious” and “false”.

Budapest Mayor's Refusal to Pay City's Taxes 'Unprecedented', Says Hungarian FM

- 22 Jan 2024 9:16 AM

- hungarymatters.hu

- current affairs

Finance Minister Mihály Varga, in an interview with the online edition of business daily Világgazdaság, said it was “unprecedented” that while Budapest residents and businesses meet their tax obligations, the city’s mayor “ignores them”.

MOL Fuel Price Hike in Hungary to Be Introduced in Two Phases

- 2 Jan 2024 12:52 PM

- http://www.hatc.hu

- shopping

MOL announced that it will implement an EU-mandated increase in the excise tax on fuel in two stages: raising prices by Ft 20 per litre on January 1, and by Ft 21 on January 15.

Blame Game: High Food Prices in Hungary Are Due to Government Windfall Taxes, Says Spar Boss

- 25 Sep 2023 12:35 PM

- http://www.hatc.hu

- shopping

Hungarian consumers have become very price-conscious in the current market environment and this is reflected in the growing market share of own-labelled products, Spar CEO Gabriella Heiszler told the annual conference of economists in Eger.

Asset Sale Helps Tesco Avoid Serious Loss in Hungary

- 31 Jul 2023 3:30 PM

- http://www.hatc.hu

- business

British-owned retailer Tesco realised Ft 723.3 billion in revenue last year, up 15.8%, as post-tax profit grew from Ft 12.9 billion to Ft 19.6 billion, lifted by the sale of assets, Portfolio writes.