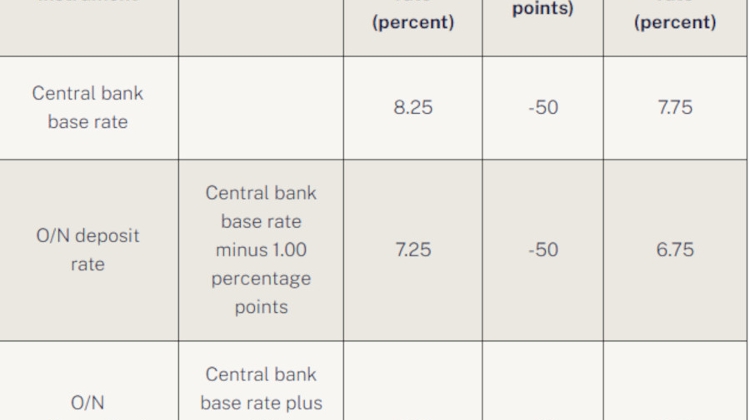

Now 7.75%: Central Bank in Hungary Cuts Base Rate Again

- 25 Apr 2024 6:56 AM

- Hungary Matters

At the previous policy meeting in March, the Council had cut the base rate by 75 basis points to 8.25%. “The outlook for inflation warrants further reduction in the base rate at a slower pace than earlier,” the Council said in a statement released after the meeting.

“The volatile risk environment continues to warrant a careful and patient approach to monetary policy,” the policy makers added. The Council noted that the slower pace was in line with the start of a “new phase” in April and said any further reductions in the base rate would be taken “in a data-driven manner”.

At a press conference after the meeting, NBH deputy governor Barnabás Virág said the slower pace of easing was justified by the inflation outlook and increasing risk aversion.

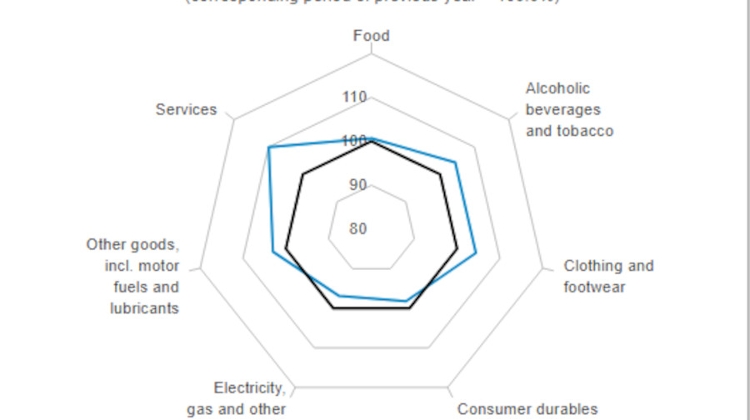

The volatile risk environment requires a “careful and patient” approach to monetary policy, he added. Virág pointed to “strong and broad-based” disinflation, but said market services were “falling slowly” from a high level, a development the Council was following with “special attention”.

He said that preserving financial market stability “remained a priority”. Virág noted that slowly dropping service price inflation was a general trend in the global economy.

He acknowledged the positive impact on Hungary’s risk assessment of historically high international reserves and an improving current-account balance, but said worsening international sentiment had driven risk premia on Hungarian assets higher in the recent period.

Fielding questions about the base rate horizon, Virág said there was “no place to rush”, adding that policy makers would take decisions “from month to month” that were appropriate based on the freshest macro data and global financial market assessments.

He said that inflation could rise temporarily from the middle of the year and that policy makers would have to weigh policy decisions “very cautiously” in the second half of the year, when room for further rate cuts could be “very limited, based on information available at present”.

He said the 50-bp cut was the only option discussed at the meeting and the decision on the reduction was unanimous.

*********************************

You're very welcome to comment, discuss and enjoy more stories, via our Facebook page:

Facebook.com/XpatLoopNews + via XpatLoop’s groups: Budapest Expats / Expats Hungary

You can subscribe to our newsletter here:

XpatLoop.com/Newsletters

Do you want your business to reach tens of thousands of potential high-value expat customers?

Then just contact us here!

LATEST NEWS IN finance