Latest Tax Guide Finds Hungary’s Tax Regime is Atypical in EU

- 22 May 2025 4:07 PM

- Hungary Around the Clock

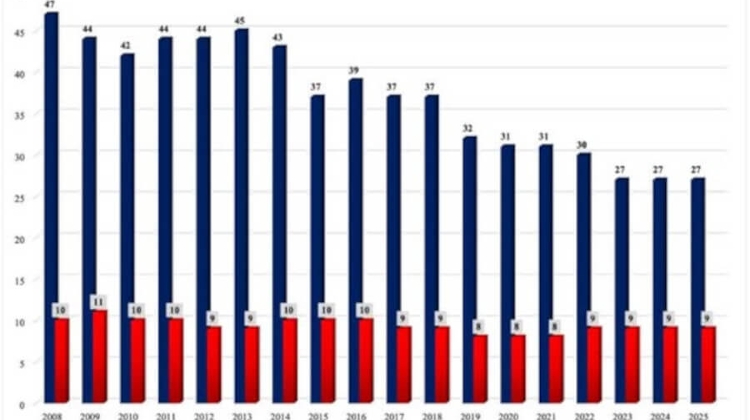

Hungary has the lowest corporate tax rate in Europe at 9%, but its 27% standard VAT rate is the highest in the EU, placing a significant portion of the tax burden on consumers.

The tax wedge for single, childless workers is 41%, above the 38% average in the region, but the rate drops to 23% for families with three children, the second lowest in the region.

Hungary’s tax model, based on low corporate taxes but high levies on consumption, contrasts sharply with more balanced systems in countries such as Austria or Germany.

Hungary is ranked at the forefront of tax digitalisation in the region thanks to the launch of real-time invoice reporting (eVAT), the online cash registers and the Ekáer system, which tracks and monitors shipments within the country.

These measures helped reduce the VAT gap to one of the lowest in Europe, the study found.

*********************************

You're very welcome to comment, discuss and enjoy more stories via our Facebook page:

Facebook.com/XpatLoopNews + via XpatLoop’s groups: Budapest Expats / Expats Hungary

You can subscribe to our newsletter here: XpatLoop.com/Newsletters

Do you want your business to reach tens of thousands of potential high-value expat customers? Then just contact us here.

LATEST NEWS IN finance