Updated: NBH Sees Inflation Slowing Further in September in Hungary

- 27 Sep 2024 6:00 AM

Presenting the NBH's fresh quarterly Inflation Report, Balatoni said CPI would rise moderately for the rest of the year, edging over 4.0pc in December.

The NBH puts 2024 average annual inflation at 3.5pc-3.9pc in the fresh report, compared to 3.0pc-4.5pc in the one published in June.

Balatoni said disinflation would continue in the first quarter of 2025, supported by a lower external cost environment and lower retrospective repricing. The effect of retrospective pricing of services will wind down, while core inflation could start to fall in the second half of the year, bringing CPI back to the central bank's 3.0pc +/-1pp tolerance band in a sustainable manner, he added.

The NBH estimates that the financial transactions duty will lift average annual inflation by 0.1pp in 2024 and 0.2pp-0.3pp in 2025, he said.

The NBH knocked down its forecast for 2024 GDP growth to 1.0pc-1.8pc from 2.0pc-3.0pc, as low order stock in the industrial sector and drought in the farming sector weigh. On the consumption side, household consumption and net exports are seen supporting growth, while investments weigh.

The re-launch of earlier postponed investments and improved external demand could result in more balanced growth in 2025, lifting GDP growth to 2.7-3.7pc. GDP growth could reach 3.5-4.5pc in 2026.

Balatoni noted that employment was at a historic high, but labour market tightness was easing as businesses tapped unused capacity and drew on labour market reserves.

The NBH reduced its forecast for this year's general government deficit to 3.5pc-4.5pc of GDP, from 4.5pc-5.0pc, on spending cuts announced in the summer. It sees a 0.3pp decline in the year-end state debt level.

Inflation in Hungary Falls Again - Lowest Level of Year

Hungary's annualised consumer price index reached 3.4pc in August, falling from 4.1pc in the previous month, data released by the Central Statistics Office (KSH) show. The numbers just released also show that annual inflation this year has not been as low as in August.

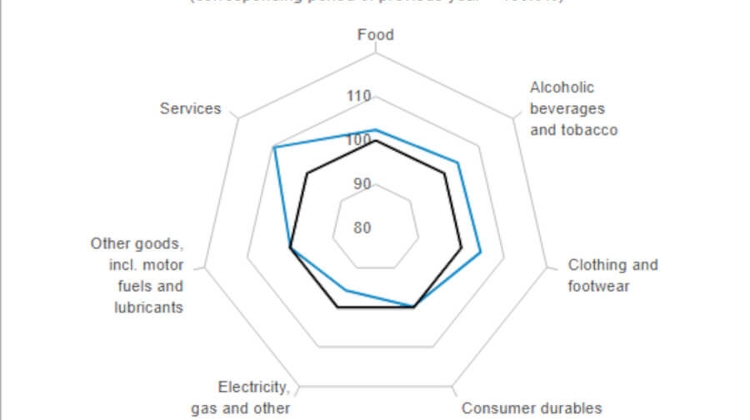

The KSH data show food prices rose 2.4pc in August. The price of flour jumped 27.7pc, pork prices edged up 3.4pc and the price of eating out increased 8.0pc, but noodle prices dropped 8.1pc, egg prices fell 7.9pc and the price of sugar dropped 4.6pc.

Household energy prices fell 4.3pc. Gas prices were 9.4pc lower and electricity prices declined 1.7pc.

Consumer durable prices edged down 0.2pc.

Motor fuel prices fell 2.9pc.

Prices of spirits and tobacco products increased 3.9pc and clothing prices rose 4.5pc. Service prices increased 9.5pc.

Core inflation, which excludes volatile fuel and food prices, was 4.6pc.

The CPI calculated with a basket of goods and services used by pensioners was 3.6pc.

In a month-on-month comparison, consumer prices were flat.

CPI Reaches New Low for Year

Commenting on the fresh data, National Economy Minister Marton Nagy said that the consumer price index had reached its lowest point of the year, so far. As in the previous months, inflation remained low in August, in line with market expectations, he added.

He said food price disinflation was driven by a significant decline in farm gate prices, indicating a further drop in prices in the coming months, which could support increased demand.

He pointed to the impact of government measures to bring down inflation -- around 80pc of which was supply-side inflation -- in the course of 2023 and said some targeted measures, such as an online price comparison platform would remain in place.

Persistently low inflation and strong wage growth translates as higher real wages, which is good for families and businesses, boosting consumer confidence and supporting an increase in consumption, he added.

Forint Edges Higher Against Euro on Interbank Forex Market

The forint traded at 396.41 to the euro around 5:30 in the evening on Wednesday, firming from 396.77 late Tuesday.

The forint edged down to 360.05 from 359.85 against the dollar. It advanced to 424.07 from 424.82 to the Swiss franc.

BUX Breaks Even

The Budapest Stock Exchange's main BUX index finished Wednesday up 0.09pc at 71,805.06, after hovering over break-even for much of the session.

OTP Bank advanced 0.83pc to HUF 18,200. Turnover of the share reached HUF 3.5bn from a HUF 6.2bn session total.

Oil and gas company MOL fell 1.22pc to HUF 2,584 on turnover of HUF 1.1bn.

Pharma share Richter rose 0.47pc to HUF 10,700 on turnover of HUF 0.8bn.

Magyar Telekom slipped 0.20pc to HUF 1,016 on turnover of HUF 0.2bn.

The bourse's mid-cap BUMIX index fell 0.89pc to 6,529.48.

Elsewhere in the region, Warsaw's WIG 20 lost 1.93pc and the Prague PX dipped 1.03pc.

In Western Europe, London's FTSE 100 was down 0.44pc ahead of the end of trade, Frankfurt's DAX edged 0.10pc lower and the CAC 40 in Paris slipped 0.41pc.

Rate-Setters Agree 'Cautious', 'Patient' Policy Approach Still Needed

Members of the Monetary Council of the National Bank of Hungary (NBH) agreed that their approach to monetary policy needed to stay "cautious" and "patient" at a monthly policy meeting in August, the minutes from the meeting released show.

"In the members' unanimous view, a cautious and patient approach to monetary policy was still necessary. Decision makers underlined that tight monetary policy continued to be key to maintaining financial market stability and to achieving the inflation target in a sustainable manner," according to the minutes of the meeting on August 27.

"However, several members indicated that after the temporary discontinuation of interest rate cuts, there might be scope for cautiously lowering interest rates further in the coming period," the minutes show.

The Council weighed two options at the meeting: leaving the base rate on hold and cutting it by 25bp. The vote to keep the base rate at 6.75pc was unanimous. The decision followed a 25bp cut at the policy meeting in July.

"Decision makers established that there were several strong arguments in favour of both options; however, leaving the base rate unchanged was a better fit to a stability-oriented approach to monetary policy in the current economic environment," according to the minutes.

"The Council was in agreement that there had been no change in the most important cornerstones of tight monetary policy," the minutes show, while "several members emphasised that interest rate cuts by the world’s leading central banks might create scope in emerging markets for easing monetary conditions in the coming period".

Source:

MTI - The Hungarian News Agency, founded in 1881.

*********************************

You're very welcome to comment, discuss and enjoy more stories via our Facebook page:

Facebook.com/XpatLoopNews + via XpatLoop’s groups: Budapest Expats / Expats Hungary

You can subscribe to our newsletter here: XpatLoop.com/Newsletters

Do you want your business to reach tens of thousands of potential high-value expat customers? Then just contact us here!

LATEST NEWS IN finance