Airline Predicaments Offer Selected Buying Opportunities

- 20 Apr 2010 3:00 AM

Airlines are starting to assess the daily cost of disruption. British Airways estimates its daily losses at GBP 15m-20m (up to USD 30 m) and Air France disclosed that its losses amount to cc. EUR 35m. Nomura has on Monday set out its own estimates of the daily impact.

"Comparing the impact with the lost stock market value shows the market is assuming closures continue into next week and beyond," Nomura said in a research note.

While there remains considerable uncertainty, Nomura sees "the risk-reward moving into the buyer's favour for airlines, especially given potential financial support from governments."

Nomura’s analysts believe the biggest opportunity is that "the market has failed to recognise the disproportional effects on the various airlines, which offers a clear relative buying opportunity in Ryanair."

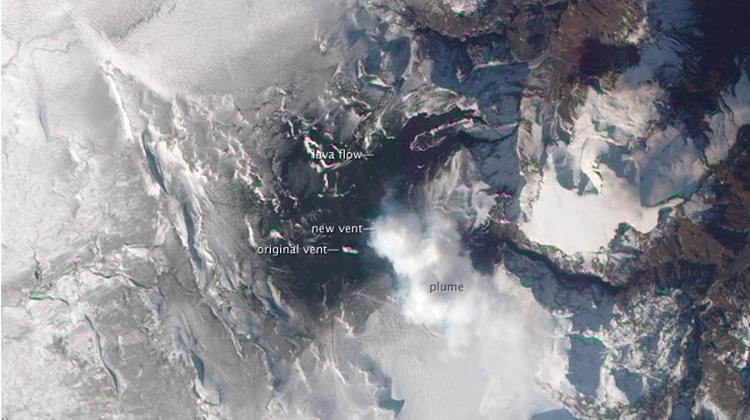

Volcanologists, meteorologists and geologists are struggling to forecast the potential future impact of Iceland’s erupting volcano, therefore Nomura’s short note merely focuses on the "current and potential financial impact of the closure of European air space, as opposed to trying to ascertain the potential re-opening of European airspace."

Below, you find the possible financial impact of a strike from the closure.

Nomura’s starting point was to review the overall revenues and then adjust for revenues, which should be less affected by the closure (eg, maintenance revenues):

With regard to the overall daily impact, Nomura considered two things;

the variable costs within the business (fuel, landing and take-off fees, catering costs, etc) and, additional costs incurred by the airlines such as hotel costs for stranded customers.

The proportional of variable costs is higher for the low-cost than for the network carriers:

The airlines are starting to announce the daily impact - British Airways and Air France have declared the daily cost, which Nomura has incorporated into its analysis:

Looking at the impact over two different timeframes - firstly, the impact to date and then the impact if the closures were to continue for the rest of this week:

"We believe this event is exceptional and should be viewed on a P/E of 1x. Furthermore, we believe the aviation trading environment backdrop is very different to previous exogenous shocks such as 9/11 and Sars. We therefore compare the share price change with the potential impact (both versus the current impact and the 'potential’ impact scenario):"

LATEST NEWS IN business