CBank Keeps Base Rate in Hungary on Hold at 13.0%

- 27 Sep 2023 12:42 PM

- Hungary Matters

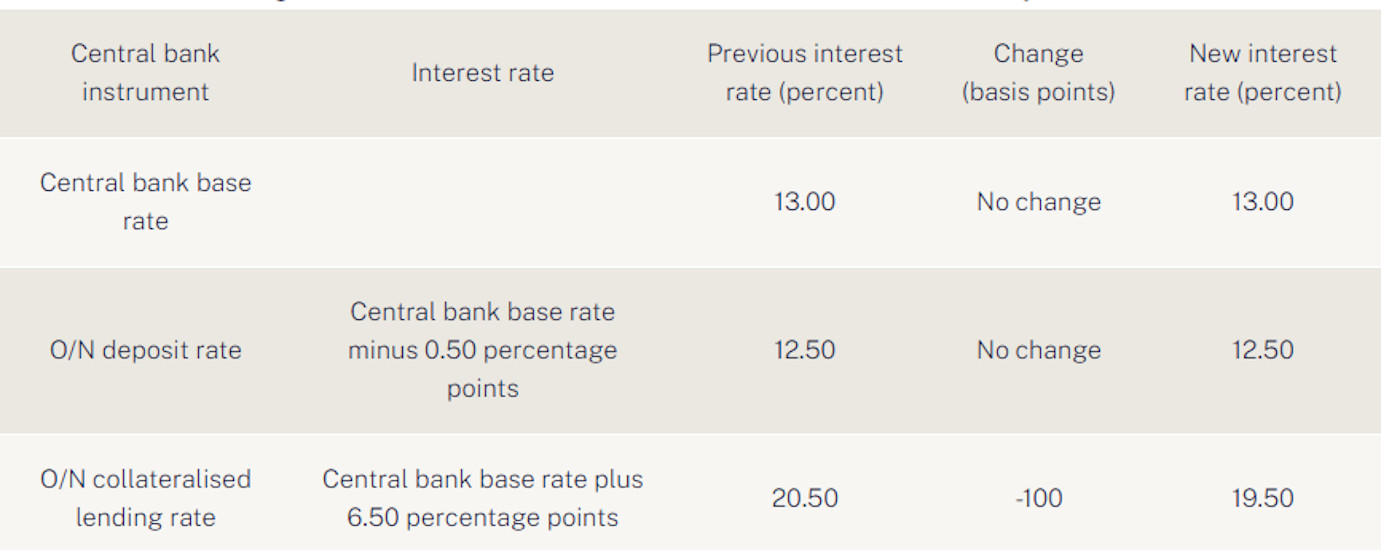

At the same time, the Monetary Council further narrowed the interest corridor, the lower band reduced by 50 basis points to 12.0% and upper band by 250 basis points to 14.0%.

In a statement released after the meeting, the Council said the gap between the NBH’s one-day quick deposits offered at daily tenders — which stands at 14.0% at present — and the base rate would close, with the base rate to be paid on the instrument for three days, from September 27 until 29, after which time the quick deposit tenders will cease.

“By closing the gap between the interest rate on the overnight quick deposit tender and the base rate, monetary policy will enter a new phase, which will provide an opportunity to develop a simpler set of instruments adapting to the changed environment,” the statement said.

The Council said that from September 27, the central bank base rate will become the National Bank of Hungary’s effective interest rate. From October 1, the NBH will pay the base rate on both mandatory reserves — excluding the part on which no interest is paid — and optional reserves.

Until the start of the new framework, the NBH will ensure the effective monetary policy transmission via overnight quick deposit tenders announced at the base rate, it said.

Meanwhile, the central bank also released the headline figures of its quarterly Inflation Report on Tuesday.

The NBH puts average annual inflation at 17.6-18.1% for 2023, compared to a 16.5-18.5% range in its previous forecast published in June.

The central bank sees average annual inflation falling to 4.0-6.0% in 2024 and to 2.5-3.5% in 2025. The bank lowered its GDP growth forecast for 2023 to -0.5-0.5% from the previous forecast of 0-1.5%. The NBH puts growth at 3.0-4.0% in 2024 and 2025.

At a press conference held after the meeting, NBH deputy-governor Barnabás Virág said policy makers had “concluded the normalisation of the extraordinary interest rate environment” with the 100 basis point reduction in the effective interest rate.

LATEST NEWS IN community & culture