Subdued Outlook: New Interest Rate Cut by National Bank in Hungary

- 25 Sep 2024 5:46 AM

At the previous policy meeting, in August, the Council had left the rate on hold.

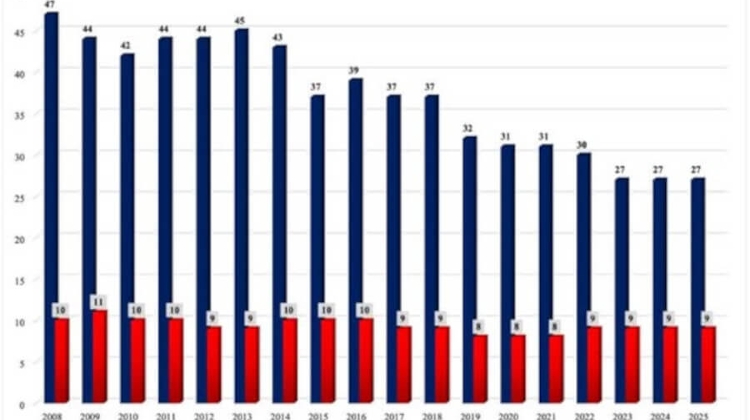

The Council also decided to lower the symmetric interest rate corridor in tandem, bringing the O/N deposit rate to 5.50pc and the O/N collateralised loan rate to 7.50pc.

In a statement released after the meeting, the Council said a looser monetary policy environment, a "subdued" outlook for external economic activity, continued disinflation, a slow recovery of consumer confidence, stable financial market developments and an improvement in Hungary's risk perception had allowed a "careful" reduction in interest rates.

"Looking ahead, risks surrounding international and domestic disinflation, as well as the volatility in investor sentiment warrant a careful and patient approach to monetary policy. The Council is constantly assessing incoming macroeconomic data, the outlook for inflation and developments in the risk environment, based on which it will take decisions on the level of the base rate in a cautious and data-driven manner,"the policy-makers added.

At a press conference after the meeting, deputy-governor Barnabas Virag said the central bank's outlook for mid-term trends impacting inflation were "fundamentally unchanged" and they expected disinflation to continue in the first quarter of 2025. The NBH puts average annual inflation at 3.5pc-3.9pc for this year, he added, citing the projections in the latest quarterly Inflation Report.

In the previous report, published in June, the NBH had put 2024 average annual inflation at 3.0pc-4.5pc.

The NBH forecasts average annual inflation of 2.7-3.6pc for 2025 in the fresh report.

It sees GDP growth reaching 1.0pc-1.8pc in 2024, on the back of household consumption, and 2.7pc-3.7pc in 2025, as the structure of growth becomes more balanced.

Virag said inflation would fall further in September, but was expected to rise temporarily until the end of the year, edging over 4pc, mainly on base effects.

He said the basis for the decision included continued disinflation, rate cuts by the US Fed and the ECB, a moderate improvement in Hungary's risk assessment and gradually strengthening confidence of economic players.

He added that a "cautious and patient" monetary policy was justified and the Council would continue to take decision in a "data-driven manner from month to month".

He said policy-makers would follow closely inflation outlooks, Hungary's risk assessment and the stability of financial markets when taking rate decisions in future, weighing either a small cut or keeping rates on hold.

Full report available here

Source:

MTI - The Hungarian News Agency, founded in 1881.

*********************************

You're very welcome to comment, discuss and enjoy more stories via our Facebook page:

Facebook.com/XpatLoopNews + via XpatLoop’s groups: Budapest Expats / Expats Hungary

You can subscribe to our newsletter here: XpatLoop.com/Newsletters

Do you want your business to reach tens of thousands of potential high-value expat customers? Then just contact us here!

LATEST NEWS IN finance