Central Bank in Hungary Cuts Base Rate Again

- 22 May 2024 11:52 AM

- Hungary Matters

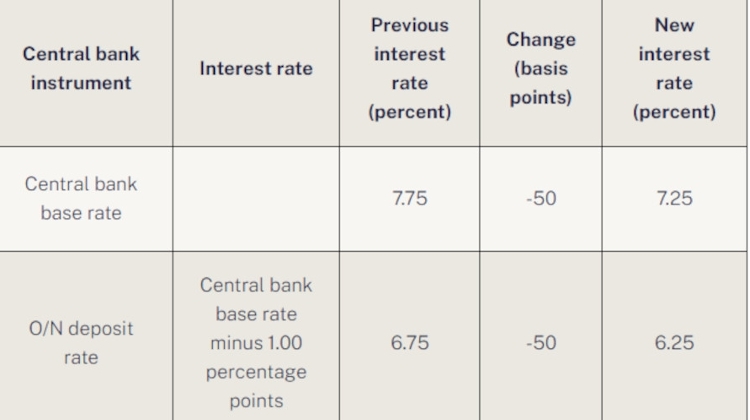

The Council also decided to lower the symmetric interest rate corridor in tandem, bringing the O/N deposit rate to 6.25% and the O/N collateralised loan rate to 8.25%.

At its April meeting, the Council had cut the base rate by 50bp.

“The volatile financial market environment and the risks to the outlook for inflation continue to warrant a careful and patient approach,” the Council said in a statement after the meeting.

The Council noted it was constantly assessing incoming macroeconomic data, the outlook for inflation and developments in the risk environment and decisions on any further reductions in the base rate would be taken “in a cautious and data-driven manner”.

Deputy central bank governor told a press conference after the meeting that accelerating economic growth, historically high foreign exchange reserves, a persistent improvement in the current account balance and a cautious approach to monetary policy have contributed to an improvement in the country’s risk perception.

Barnabás Virág said the volatile financial market environment and the risks to the outlook for inflation continue to warrant a careful and patient approach and that the Council was unanimous in its opinion that preserving financial market stability remains a priority.

Full report available here

*********************************

You're very welcome to comment, discuss and enjoy more stories via our Facebook page:

Facebook.com/XpatLoopNews + via XpatLoop’s groups: Budapest Expats / Expats Hungary

You can subscribe to our newsletter here:

XpatLoop.com/Newsletters

Do you want your business to reach tens of thousands of potential high-value expat customers?

Then just contact us here!

LATEST NEWS IN finance