Analysts Assess Impact of New 3% Mortgage Scheme in Hungary

- 7 Jul 2025 10:13 AM

Bankmonitor calculates that, at 3% interest, borrowers would pay Ft 166,000 in monthly instalments on a Ft 30 million loan, compared to Ft 223,000 at current market rates, resulting in savings of Ft 14 million over the 20-year tenure of the loan.

This could enable buyers to borrow more and bid higher for properties, potentially fuelling price increases across the market.

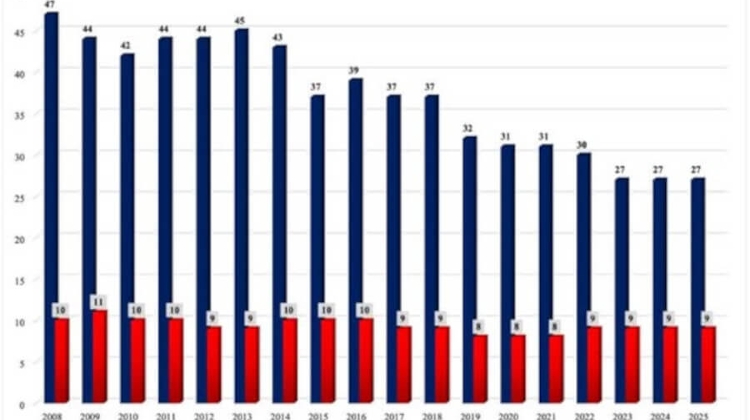

Based on the transaction numbers known so far this year, the housing market could easily exceed 120,000 transactions in 2025. Based on this, 30,000-36,0000 sales contracts could be related to first-time property purchases. This is a substantial part of the real estate market, adds analyst József Árgyelán of Bankmonitor.

He noted that favourable interest rates might encourage even those with sufficient savings to take out loans, potentially driving prices higher, unlike the limited impact of the earlier voluntary 5% APR cap.

Prime Minister’s Office leader Gergely Gulyás on Thursday unveiled some details of the scheme.

Borrowers need at least two years of social security coverage to be eligible and the value of the property must not exceed Ft 100 million.

The government has also set a Ft 1.5 million per square metre threshold for both purchases and new builds.

*********************************

You're very welcome to comment, discuss and enjoy more stories via our Facebook page:

Facebook.com/XpatLoopNews + via XpatLoop’s groups: Budapest Expats / Expats Hungary

You can subscribe to our newsletter here: XpatLoop.com/Newsletters

Showcase Your Business to Expats in the Loop:

As an independent portal we’re grateful to all commercial supporters who help keep you in the loop with fresh insights and inspiration. Do you want your business to reach tens of thousands of potential high-value expat customers? If so please contact us here.

LATEST NEWS IN finance