Sales Up 20% Straight After Home Start Launch in Hungary

- 24 Sep 2025 6:54 AM

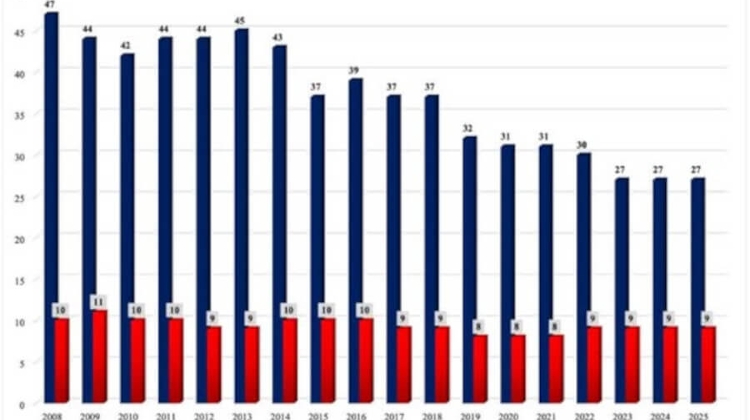

Home sales stood at 26,451 in the first three weeks of September, suggesting full-year sales could climb to 160,000, a threshold reached only twice in the past ten years, ingatlan.com said.

The Home Start Programme offers first-time home buyers loans up to HUF 50m at a fixed 3pc.

8.2% Plan to Apply for Hungary’s Home Start Loan Scheme

A new survey by the economic research institute GKI shows that 8.2% of Hungarian adults are considering joining the government’s Home Start subsidised loan scheme for first-time homebuyers, which will run from September until next February.

According to the poll, 3.7% of respondents said they were very likely to apply, 4.4% said they were somewhat likely, while 91.8% either had no plans or remained undecided.

GKI noted that if only those who described themselves as “very likely” to participate followed through, the scheme could draw around 152,000 applicants. This figure is significant, given that a total of 127,000 housing transactions were completed across Hungary in 2024.

Interest in the programme is higher in the capital, with around 12% of Budapest residents saying they plan to apply, compared with 6–8% in other parts of the country.

The survey also highlighted differences by profession: 19% of business owners expressed an intention to make use of the scheme, in contrast to just 6% of manual workers.

More about Home Start Programme:

The Hungarian government has released a draft decree outlining the Home Start Programme, a subsidised loan scheme designed to support first-time property buyers.

According to a statement from the Prime Minister’s Office, the initiative is aimed primarily at young Hungarians, with the potential to enable tens of thousands of people to purchase their first homes in the coming years.

From September 1, a fixed-rate loan of 3% will be offered up to a maximum of HUF 50 million, open to all first-time home buyers regardless of age or family circumstances.

The programme is accessible to applicants who have not owned residential property within the past ten years, to those holding real estate worth less than HUF 15 million, and to individuals with a maximum ownership share of 50% in a home. Eligibility also covers those whose property is earmarked for demolition or, in certain cases, is burdened by usufruct rights.

For couples, whether married or in registered partnerships, only one partner is required to fulfil the property ownership criteria.

Applicants must be at least 18 years old and demonstrate that their social security contributions have been paid for no less than two years. They must also provide proof of having no outstanding tax liabilities, no criminal record, and must satisfy lenders’ requirements for creditworthiness.

Under the programme, the maximum purchase price of eligible homes is capped at HUF 100 million for apartments in multi-unit buildings and HUF 150 million for standalone houses, with a per-square-metre ceiling set at HUF 1.5 million.

The required down payment for loans within the scheme is 10%.

The draft decree specifies that applications for the Home Start Programme opened on September 1.

Source: MTI – Hungary’s national news agency since 1881. While MTI articles are usually factual, some may contain political bias, and readers should be aware that such content does not reflect the position of XpatLoop, which is neutral and independent.

Since the goal of XpatLoop is to keep readers well briefed, right across the spectrum of opinions, MTI items are shared to ensure readers are aware of all narratives within the local media.

XpatLoop believes in empowering readers to form their own views through complete and comprehensive coverage. To facilitate this XpatLoop has a balanced range of news partners, as you can see when you surf around XpatLoop.com

*********************************************************************************************

You're very welcome to comment, discuss and enjoy more stories via our Facebook page:

Facebook.com/XpatLoopNews + via XpatLoop’s groups: Budapest Expats / Expats Hungary

You can subscribe to our newsletter here: XpatLoop.com/Newsletters

Showcase Your Business to Expats in the Loop:

As an independent portal we’re grateful to all commercial supporters who help keep you in the loop with fresh insights and inspiration. Do you want your business to reach tens of thousands of potential high-value expat customers? If so please contact us here.

LATEST NEWS IN property