32 result(s) for borrowers in Property

Updated: Will New Credit Scheme for First-Time Home Buyers in Hungary Reshape Rental Market?

- 22 Jul 2025 2:03 PM

- property

The government's recently announced Home Start programme, which will offer subsidised credit to first-time home buyers, could reshape Hungary's rentals market, mitigating rising rents and boosting supply, property listings site ingatlan.com said on Monday.

Home Rental Rates Rise Again in Hungary - Changing Trend Ahead?

- 21 Jul 2025 2:51 PM

- property

Home rental rates in Hungary rose 7.3pc year-on-year in June, data compiled by the Central Statistics Office (KSH) from listings site Ingatlan.com show.

Updated: New 3% Mortgage Scheme in Hungary for First-Time Buyers

- 14 Jul 2025 2:04 PM

- property

The government has approved a 3pc home purchase credit programme for first-time buyers, Prime Minister Viktor Orban said during a break at a cabinet meeting.

'Lively' Home Market in Hungary - Latest Analysis Reveals Price & Sales Trends

- 21 Nov 2024 8:40 AM

- property

Demand on the Hungarian home market is "lively" and could increase further in 2025, although home purchases for investment will dominate, Sandor Winkler, a department head at the National Bank of Hungary (NBH), said presenting the central bank's latest report on the market.

Home Sales Climb 21% in Hungary

- 3 Jan 2024 9:00 AM

- hungarymatters.hu

- property

Home sales in Hungary rose by an annual 21% to 7,813 in December, a monthly estimate by listed real estate broker Duna House shows. For the full year, home sales reached 90,840, down 27% from 2022.

Housing Sales in Hungary Hit Lowest Level This Year

- 15 Nov 2022 7:28 AM

- http://www.hatc.hu

- property

Home sales in Hungary fell 9% on a monthly basis and by 28% year-on-year to 8,859 in October, the lowest level this year, real estate broker Duna House said in a monthly estimate.

Borrowers Face Dire Impact of Rising Loan Rates in Hungary

- 25 Apr 2022 11:49 AM

- http://www.hatc.hu

- property

Hungarian mortgage rates have surged in recent months due to rising inflation and the MNB’s subsequent monetary tightening, which means that the size of loans that borrowers can take out under the MNB debt cap rules has declined significantly in one year, Portfolio writes in an analysis.

Loan Moratorium Rules Amended by Hungary

- 20 Sep 2021 6:43 AM

- http://www.hatc.hu

- property

The amendment of moratorium rules on credit card debt affects 400,000 contracts, worth some Ft 95 billion, MNB spokesman István Binder said on Thursday, after the government issued decrees on the loan repayment moratorium on Wednesday.

Bankers Welcome Tighter Mortgage Rules

- 20 Jun 2018 7:29 AM

- hungarymatters.hu

- property

The Hungarian Banking Association has welcomed plans by the National Bank of Hungary (NBH) to lower statutory debt-to-income ratios for mortgage borrowers who do not take out loans with rates fixed for period of at least ten years.

Updated: Will New Credit Scheme for First-Time Home Buyers in Hungary Reshape Rental Market?

- 22 Jul 2025 2:03 PM

- property

The government's recently announced Home Start programme, which will offer subsidised credit to first-time home buyers, could reshape Hungary's rentals market, mitigating rising rents and boosting supply, property listings site ingatlan.com said on Monday.

Home Rental Rates Rise Again in Hungary - Changing Trend Ahead?

- 21 Jul 2025 2:51 PM

- property

Home rental rates in Hungary rose 7.3pc year-on-year in June, data compiled by the Central Statistics Office (KSH) from listings site Ingatlan.com show.

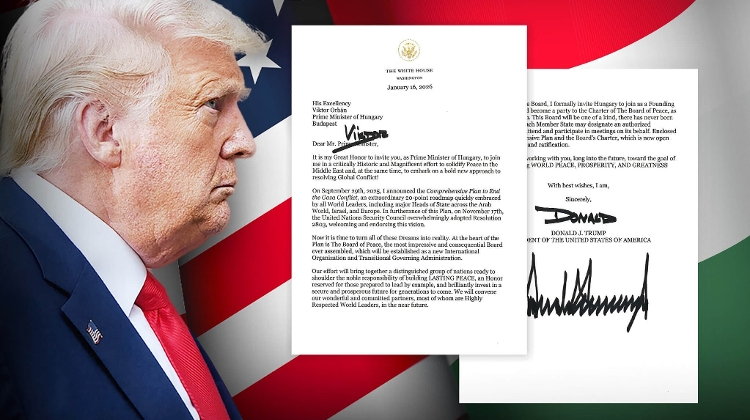

Updated: New 3% Mortgage Scheme in Hungary for First-Time Buyers

- 14 Jul 2025 2:04 PM

- property

The government has approved a 3pc home purchase credit programme for first-time buyers, Prime Minister Viktor Orban said during a break at a cabinet meeting.

'Lively' Home Market in Hungary - Latest Analysis Reveals Price & Sales Trends

- 21 Nov 2024 8:40 AM

- property

Demand on the Hungarian home market is "lively" and could increase further in 2025, although home purchases for investment will dominate, Sandor Winkler, a department head at the National Bank of Hungary (NBH), said presenting the central bank's latest report on the market.

Home Sales Climb 21% in Hungary

- 3 Jan 2024 9:00 AM

- hungarymatters.hu

- property

Home sales in Hungary rose by an annual 21% to 7,813 in December, a monthly estimate by listed real estate broker Duna House shows. For the full year, home sales reached 90,840, down 27% from 2022.

Housing Sales in Hungary Hit Lowest Level This Year

- 15 Nov 2022 7:28 AM

- http://www.hatc.hu

- property

Home sales in Hungary fell 9% on a monthly basis and by 28% year-on-year to 8,859 in October, the lowest level this year, real estate broker Duna House said in a monthly estimate.

Borrowers Face Dire Impact of Rising Loan Rates in Hungary

- 25 Apr 2022 11:49 AM

- http://www.hatc.hu

- property

Hungarian mortgage rates have surged in recent months due to rising inflation and the MNB’s subsequent monetary tightening, which means that the size of loans that borrowers can take out under the MNB debt cap rules has declined significantly in one year, Portfolio writes in an analysis.

Loan Moratorium Rules Amended by Hungary

- 20 Sep 2021 6:43 AM

- http://www.hatc.hu

- property

The amendment of moratorium rules on credit card debt affects 400,000 contracts, worth some Ft 95 billion, MNB spokesman István Binder said on Thursday, after the government issued decrees on the loan repayment moratorium on Wednesday.

Bankers Welcome Tighter Mortgage Rules

- 20 Jun 2018 7:29 AM

- hungarymatters.hu

- property

The Hungarian Banking Association has welcomed plans by the National Bank of Hungary (NBH) to lower statutory debt-to-income ratios for mortgage borrowers who do not take out loans with rates fixed for period of at least ten years.