Online Invoices & Cash Register – How To Avoid Double Reporting In Hungary

- 23 Jun 2020 9:29 AM

As of 1 July 2020, the scope of tax exempt transactions in which invoices are not required will decrease. In case of miscellaneous education and the sales of exempt properties, it will be required to issue an invoice. It is still not required to issue an invoice (an accounting receipt is necessary instead) in case of renting exempt properties.

In case of advances, in respect of the invoice or document considered the same as an invoice about the final performance, the difference resulting in calculating the advance must be reported.

As of 1 July 2020, the 15-day deadline considered reasonable for issuing the invoice is reduced to 8 days. This means that the invoice must be issued within 8 days of performance.

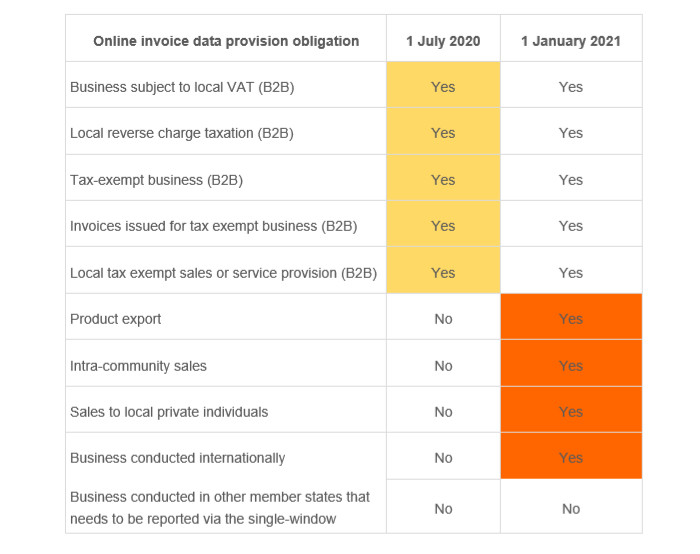

The abovementioned data disclosure obligation can be done discharged via the Online Invoice interface.

The taxpayer must register his company or himself on this site: “Adatszolgáltatásra kötelezett Adózói regisztráció” and should sign in with his “Ügyfélkapu”.

Beyond 1th. July of 2020, issuing invoices by hand may not become forbidden, but in case handwritten invoice with the application of a form (e.g. a block of invoices), the data disclosure must be performed within 4 calendar days in such a way that data must be recorded on a website.

However, if such an invoice contains output tax of HUF 500,000 or even more, the data disclosure must be performed on the day following the day when the invoice was issued.

From our point of view, recording the data content of a handwritten invoice on the above mentioned website causes too big administrative burden for the taxpayer, for this reason it is recommended to opt for applying invoicing software.

Based on Section 178 (1) (a) of the VAT Act, where the obligation of issuing receipts is satisfied with cash register, the taxpayer regularly supplies data about the receipts + invoices made out with cash register + other related data of the cash register. Invoices made out by cash registers are not subject to the online data supply regime on invoices applicable from 1 July 2020.

The obligation of online cash register operators will not be amended from the date referred, i.e. the cash register will continue to provide the Tax Authority with data on invoices made out by the cash register.

Most important avoid double reporting in case using cash register. However, a taxpayer who issues a cash paid invoice for another domestic taxable person by an invoice program and enters in the cash register as well, it will generate a double tax report. It could be eliminated by the use of cash register for issuing invoice.

The two kind of cash income also requires the split use of cash register management, it makes the revision of cash management and cash management rules required.

Contact our experts to get more information or help in method of register.

Click here to visit Colling Accounting & Consulting online

LATEST NEWS IN specials