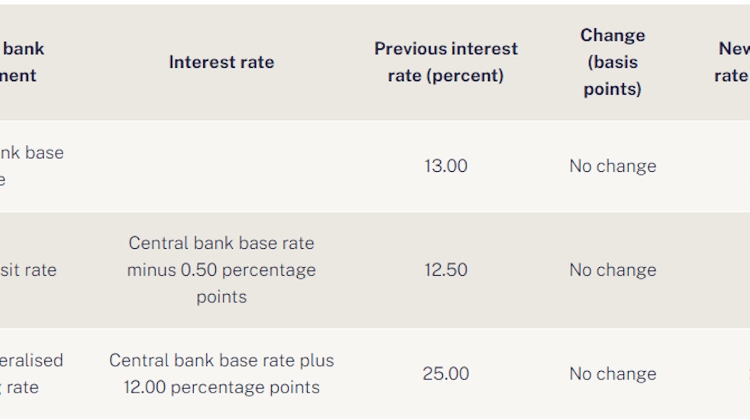

Rate-Setter Warns About Underestimating Risk of Persistent Rise in Inflation

- 18 Sep 2021 9:26 AM

- Hungary Matters

Addressing an event organised by fund manager Aegon Alapkezelő, he said, however, inflation had already taken root in the world economy well before the pandemic.

Inflation has taken off wherever economic relaunches have been robust, and this is the “price” effective recovery, he said. But recoveries could be jeopardized were inflation to become onerous, he warned.

The lesson for Hungary’s central bank is that the risk of inflation must be addressed and safeguards put in place in case large central banks narrow their asset purchase programmes, he said.

LATEST NEWS IN finance