Hungary Central Bank Raises Key Rate by 30 Basis Points

- 17 Nov 2021 6:19 AM

- Hungary Matters

The policymakers accelerated the tightening cycle following 15 basis point hikes in the previous two months after inflation in October hit 6.5%.

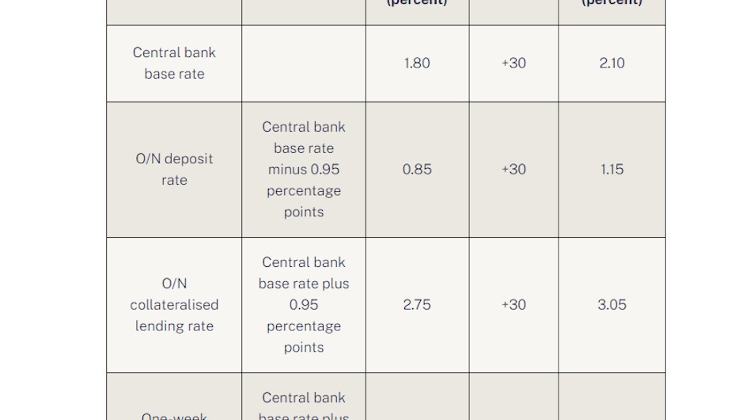

Besides the hike to the base rate today, the Monetary Council raised the O/N deposit rate by 30bp to 1.15% and the O/N and one-week collateralised loan rates by 30bp to 3.05%.

The O/N deposit rate and the collateralised loan rate mark the bottom and the top, respectively, of the central bank’s “interest rate corridor”.

“A persistent rise in external inflationary pressures and increasing second-round inflation risks have necessitated more extensive and longer lasting monetary policy tightening,” the Council said in a statement released after the meeting.

The policy makers also signalled a continuation of monthly hikes, while noting that the central bank’s next quarterly Inflation Report, due out in December, “will be decisive in determining the further extent of interest rate hikes”.

“The Monetary Council will continue the cycle of interest rate hikes until the outlook for inflation stabilises around the central bank target in a sustainable manner and inflation risks become evenly balanced on the horizon of monetary policy,” the rate-setters said, reiterating their earlier policy stand.

The Council said CPI is “expected to rise above 7%” in November and “decline only slowly” from the end of 2021, adding that inflation in 2022 is expected to be “substantially higher” than the projection in the September Inflation Report.

“Higher-than-expected and sustained increases in commodity prices are rapidly being incorporated into consumer prices in a buoyant domestic demand environment, leading to rising inflation in general,” the Council said.

“Persistently high commodity and energy prices, rises in international freight costs and increasingly wider supply disruptions continue to point to a higher and more persistent external inflation environment.

The tight labour market, coupled with strong wage growth and a higher inflation environment, may lead to increases in inflation expectations and to strengthen second-round inflation risks,” the Council added.

The Council noted that the base rate tightening cycle is its response to “longer-term internal fundamental changes in the outlook for domestic inflation” and said it intends to “shape [inflation] expectations appropriately” by continuing to raise the key rate.

The Council also said the NBH must respond to a recent increase in short-term risks in financial and commodity markets “quickly and flexibly”, adding that it “must be ready to set the interest rate on the one-week deposit above the base rate”.

LATEST NEWS IN entertainment