Forint Strengthens After New Base Rate Hike Up to 9.75%

- 13 Jul 2022 10:52 AM

- Hungary Matters

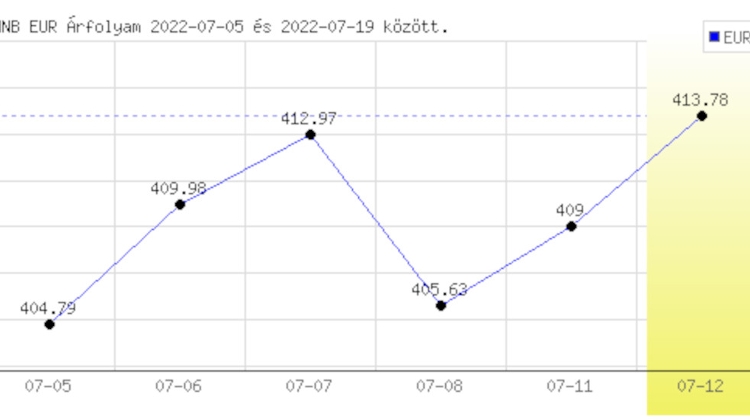

The forint firmed 10 minutes after the announcement by 0.5-0.6% to 410.30 forints from 412.25.

The dollar went from 411.82 forints to 409.40 after the announcement, while the Hungarian currency strengthened to 415.40 against the Swiss franc from 417.87. In the past week, the forint dropped to 417.03 against the euro.

At the end of June, the central bank raised its base rate by 185 basis points to 7.75%, while last Thursday, the bank raised the one-week deposit rate by 200 basis points in response a new record low the previous day.

At Tuesday’s interest rate meeting, the central bank raised the central bank base rate by 200 basis points to 9.75%, which now matches the O/N deposit rate.

Hungary Central Bank Raises Base Rate by 200 Basic Points

Hungarian rate-setters raised the central bank’s base rate by 200 basis points, to 9.75%, at an extraordinary meeting on Tuesday.

The Council also decided on Tuesday to raise the O/N deposit rate by 200 basis points to 9.25% and the O/N and one-week collateralised loan rates by 200bp to 12.25%.

The O/N deposit rate and the collateralised loan rate mark the bottom and the top, respectively, of the central bank’s “interest rate corridor”.

The forint traded at 410.59 to the euro around 15 minutes after the decision was announced, firming from 412.18 a little before 1pm.

National Bank of Hungary deputy governor Barnabás Virág said after the meeting that continued rising inflation and prolonged inflation risks made it necessary to continue the base-rate tightening cycle.

The NBH continuously monitors developments in financial market risks and stands ready to intervene in a decisive manner using every instrument in its monetary policy toolkit, if necessary, Virág said.

In the interest of mitigating second-round inflation risks, maintaining tighter monetary conditions for a longer period of time is warranted, he added.

LATEST NEWS IN finance