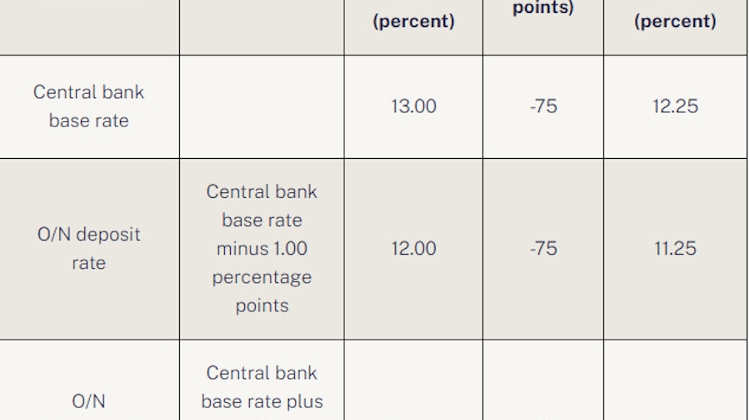

Central Bank in Hungary Cuts Base Rate to 12.25%

- 25 Oct 2023 12:11 PM

The Monetary Council also decided to lower the symmetric interest rate corridor in tandem, bringing the O/N deposit rate to 11.25% and the O/N collateralised loan rate to 13.25%.

The National Bank of Hungary (NBH) raised the base rate for the last time in September 2022, by 125 basis points to 13%.

A month later, it announced the end of the cycle of base rate hikes and resorted to other methods of monetary tightening. It raised the O/N deposit quick tender rate to 18%, and has lowered it by 100 basis points every month since May.

In a statement released after the meeting, the Council said strong disinflation and Hungary’s reduced vulnerability allowed the central bank to continue shaping monetary conditions by lowering the base rate.

“At the same time, a cautious approach and a slower pace of interest rate cuts are warranted in view of the increasing external risks,” it added.

The growing pace of disinflation has allowed the domestic real interest rate to move into positive territory in September “and, with inflation falling dynamically, it is expected to rise gradually until the end of the year”, the Council said.

They added that the risks surrounding global disinflation and volatility in international investor sentiment warranted a cautious approach to monetary policy.

At a press event held after the meeting, NBH deputy governor Barnabás Virág said monetary policy had entered a new phase, adding that the Monetary Council will make decisions based on the factors affecting the inflation outlook and developments in the risk environment in the coming period.

Full report available here

LATEST NEWS IN current affairs