Inflation Falls Again in Hungary, Averaging 17.6% Last Year - Forecast for 2024 Released

- 15 Jan 2024 11:24 AM

- Hungary Matters

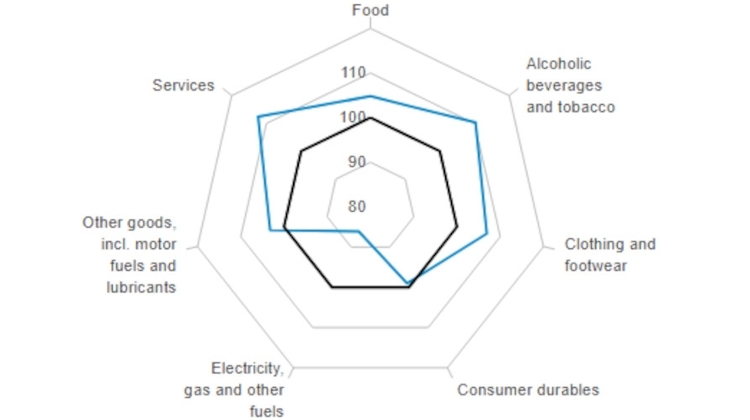

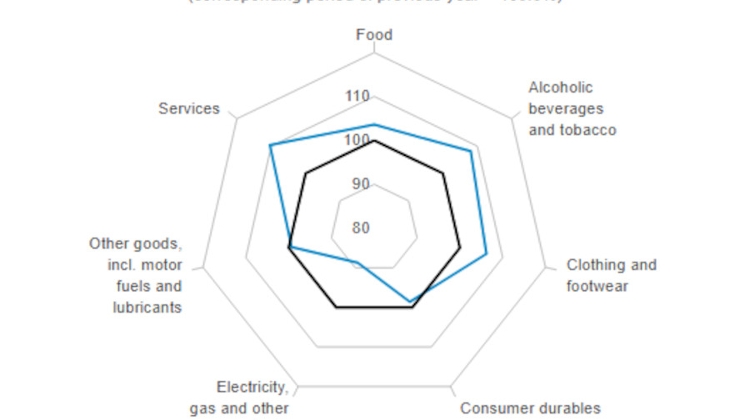

Month on month, inflation fell by 0.3%. Food prices increased by 4.8%, while household energy prices went down by 13.9%.

Services prices were up 12.4%, while consumer durables fell by 1.0%. The full year annual reading for food prices was a rise of 25.9%, while household energy went up by 22.1%.

Economic development minister Márton Nagy said in a statement that the government had, two month ahead of schedule, fulfilled its promise to cut inflation, and the 5.5% annual inflation reported in December was better than the relevant figures in the Czech Republic (6.9%), Poland (6.1%) and Romania (6.6%).

The month-on-month decrease of 0.3% was also significant in December, with a drop in the prices of food, household energy and vehicle fuel, he added.

Nagy said the government would now focus “on the main task of 2024” of restoring economic growth.

In order to achieve GDP growth of around 4%, he said progress must be made in three areas: increasing public consumption, domestic production and investment, and the activity rate of the labour market must grow from the current 78% to 85% for 15-64 year-olds, he added.

Given 5.5% inflation and the central bank base rate in December set at 10.75%, the real interest rate, he noted, is still above 5%, “which continues to impact negatively on economic performance”.

Full KSH report available here

Expert Forecast for 2024

Inflation Could Fall Within the Central Bank’s Tolerance Band in January

Based on the latest data, ING conclude that inflation could slow further in early 2024, and ING's latest forecast suggests that it could fall below the upper band of the central bank's 4% inflation target tolerance band as early as January. But this will be more a result of base effects than the lack of underlying price dynamics.

However, it would be premature to declare victory as positive base effects will soon run out. As a result, ING expect inflation to rise again in the second half of this year. While inflation could average a tad below 4% in the first half of the year, it could be around 5% in the second half of 2024 and around 6% at the end of this year.

More:

ing.com

Related links

LATEST NEWS IN finance