617 result(s) for forint rate

Hungary’s 2016 Budget “Designed To Boost Economy, Help Families”

- 1 Jun 2015 9:00 AM

- business

The government seeks to promote job creation and boost the economy as well as provide assistance to families, a state secretary of the economy ministry said in his introduction to the parliamentary debate on next year’s budget. Béla Glattfelder said the bill would introduce changes to 18 laws, including rules governing efforts to reduce Hungary’s state debt. The current growth and inflation path ...

Hungary’s Ad Tax Exemption Threshold Still Too High For Brussels

- 19 May 2015 9:00 AM

- business

The European Commission believes the proposed 100 million forints (EUR 325,000) exemption threshold for the advertising tax is still too high. The government is in talks with Brussels on the matter, Economy Minister Mihály Varga told commercial television ATV. The government has proposed making the ad tax rate a flat 5.3%, but allowing an exemption on a tax base up to 100 million forints.

2016 Tax Changes In Hungary “Simplest Ever”

- 15 May 2015 9:00 AM

- business

The 2016 tax bill just submitted to parliament contains the shortest tax provisions ever and introduces no new taxes, state secretary András Tállai said. New elements of the tax measures include a scheme called “tax loan for growth”, which means that companies that manage to raise their pre-tax profits five-fold in a year can defer their tax payments, thereby gaining resources for further ...

Hungarian Govt To Propose Stability Act Amendment

- 12 May 2015 9:00 AM

- business

The government will initiate an amendment to a rule on a nominal state debt threshold to better support economic growth. The Economy Ministry responded to a query by MTI after the Fiscal Council made a recommendation on the rule.

Ad Tax Changes Would Hurt Hungarian Consumer Goods Market

- 12 May 2015 9:00 AM

- business

Retailers could be seriously hurt by changes to the advertisement tax, especially in the consumer goods segment, the National Association of Retailers (OKSZ) reported. The consumer goods market is extremely price sensitive and both retailers and suppliers have a vested interest in curbing price rises, the OKSZ said in a statement.

VAT On Internet Subscriptions In Hungary May Be Cut To 18%

- 8 May 2015 4:00 AM

- tech

The VAT rate on internet subscriptions may be reduced from 27% to 18% from next January, daily Napi Gazdaság said. Further, one of the main pillars of the public utilities tax may be reduced from 2017. The reduction would be a quid pro quo for telecommunication companies helping to develop a superfast broadband network, to which the government may contribute 150 billion forints (EUR 492m), the ...

Industry Associations In Hungary Call For Further Consultations On Ad Tax

- 7 May 2015 9:00 AM

- business

Industry associations continue to call for consultations on the tax on advertisements, asking the government to consider abolishing the tax due to its detrimental effect on the economy, the Hungarian Advertising Association said. In consent with another nine organisations, the association said the planned amendment to the ad tax would curb growth opportunities for micro- and small businesses and ...

Positive Economic Outlook Key To Construction Sector Upswing In Hungary

- 6 May 2015 9:00 AM

- property

The major improvement in Hungary’s economic outlook has led to the emergence of the real estate market and construction sector from the doldrums, Economy Minister Mihály Varga told a conference. The construction sector can only add new real estate in places where there is confidence about the future of the economy, Varga told the conference organised by business daily Napi Gazdaság, adding that ...

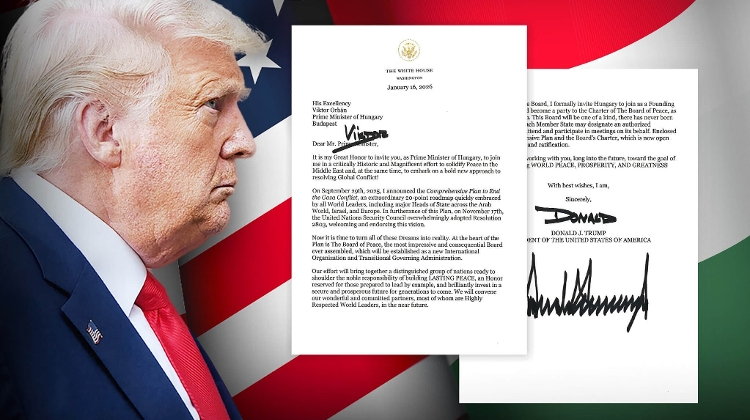

Hungary's PM: 2016 Budget Planning Means “Everyone Can Move Forward”

- 27 Apr 2015 10:00 AM

- business

Thanks to the government’s advance planning for the 2016 budget “everyone can move forward,” Prime Minister Viktor Orbán said in his regular Friday morning interview with public radio. The goal is to push the jobless rate down to around 3% by 2018- 2019, which in effect would mean full employment. Tax cuts are a means to stimulate employment and they are also tantamount to a pay rise, he added.

Hungary’s 2016 Budget “Designed To Boost Economy, Help Families”

- 1 Jun 2015 9:00 AM

- business

The government seeks to promote job creation and boost the economy as well as provide assistance to families, a state secretary of the economy ministry said in his introduction to the parliamentary debate on next year’s budget. Béla Glattfelder said the bill would introduce changes to 18 laws, including rules governing efforts to reduce Hungary’s state debt. The current growth and inflation path ...

Hungary’s Ad Tax Exemption Threshold Still Too High For Brussels

- 19 May 2015 9:00 AM

- business

The European Commission believes the proposed 100 million forints (EUR 325,000) exemption threshold for the advertising tax is still too high. The government is in talks with Brussels on the matter, Economy Minister Mihály Varga told commercial television ATV. The government has proposed making the ad tax rate a flat 5.3%, but allowing an exemption on a tax base up to 100 million forints.

2016 Tax Changes In Hungary “Simplest Ever”

- 15 May 2015 9:00 AM

- business

The 2016 tax bill just submitted to parliament contains the shortest tax provisions ever and introduces no new taxes, state secretary András Tállai said. New elements of the tax measures include a scheme called “tax loan for growth”, which means that companies that manage to raise their pre-tax profits five-fold in a year can defer their tax payments, thereby gaining resources for further ...

Hungarian Govt To Propose Stability Act Amendment

- 12 May 2015 9:00 AM

- business

The government will initiate an amendment to a rule on a nominal state debt threshold to better support economic growth. The Economy Ministry responded to a query by MTI after the Fiscal Council made a recommendation on the rule.

Ad Tax Changes Would Hurt Hungarian Consumer Goods Market

- 12 May 2015 9:00 AM

- business

Retailers could be seriously hurt by changes to the advertisement tax, especially in the consumer goods segment, the National Association of Retailers (OKSZ) reported. The consumer goods market is extremely price sensitive and both retailers and suppliers have a vested interest in curbing price rises, the OKSZ said in a statement.

VAT On Internet Subscriptions In Hungary May Be Cut To 18%

- 8 May 2015 4:00 AM

- tech

The VAT rate on internet subscriptions may be reduced from 27% to 18% from next January, daily Napi Gazdaság said. Further, one of the main pillars of the public utilities tax may be reduced from 2017. The reduction would be a quid pro quo for telecommunication companies helping to develop a superfast broadband network, to which the government may contribute 150 billion forints (EUR 492m), the ...

Industry Associations In Hungary Call For Further Consultations On Ad Tax

- 7 May 2015 9:00 AM

- business

Industry associations continue to call for consultations on the tax on advertisements, asking the government to consider abolishing the tax due to its detrimental effect on the economy, the Hungarian Advertising Association said. In consent with another nine organisations, the association said the planned amendment to the ad tax would curb growth opportunities for micro- and small businesses and ...

Positive Economic Outlook Key To Construction Sector Upswing In Hungary

- 6 May 2015 9:00 AM

- property

The major improvement in Hungary’s economic outlook has led to the emergence of the real estate market and construction sector from the doldrums, Economy Minister Mihály Varga told a conference. The construction sector can only add new real estate in places where there is confidence about the future of the economy, Varga told the conference organised by business daily Napi Gazdaság, adding that ...

Hungary's PM: 2016 Budget Planning Means “Everyone Can Move Forward”

- 27 Apr 2015 10:00 AM

- business

Thanks to the government’s advance planning for the 2016 budget “everyone can move forward,” Prime Minister Viktor Orbán said in his regular Friday morning interview with public radio. The goal is to push the jobless rate down to around 3% by 2018- 2019, which in effect would mean full employment. Tax cuts are a means to stimulate employment and they are also tantamount to a pay rise, he added.