426 result(s) for income tax

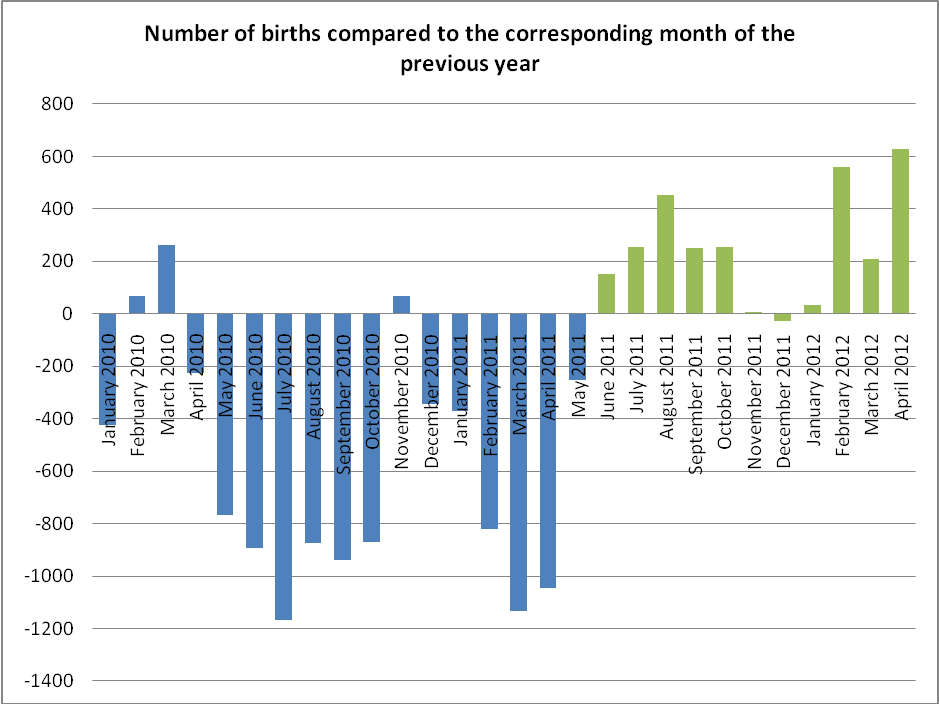

The New Hungarian Family-Friendly Tax System Boosted The Propensity To Take On More Children

- 22 Jun 2012 8:00 AM

- current affairs

The proportionate flat rate tax system has delivered the expected results. The family tax allowance introduced together with the proportionate flat rate tax stimulates families to take on more children which impact has also been manifested in the significant increase of the number of births.

EU To Lift Suspension Of EU Funds For Hungary

- 7 Jun 2012 10:55 AM

- current affairs

The European Commission recommended last week that the planned freeze of €495 million in EU cohesion fund payments to Hungary in 2013 be lifted, saying the country has taken the necessary measures to correct the excessive budget deficit. EU finance ministers, who decided in April to suspend the funds, are expected to formally confirm the EC decision on June 22.

Hungarian Gov's Response To Transparency International’s Report

- 7 Jun 2012 9:08 AM

- current affairs

Hungarian governments in the last twenty years combined have not done as much for preventing and reducing corruption and for achieving accountability as the government currently in office has in the past two years. We acknowledge with regret that this fact has been omitted from the organisation’s report, and we are therefore unable to embrace or agree with most of its findings.

Hungary's PM Orbán Earned Nearly HUF 19 Million Last Year

- 7 Jun 2012 9:00 AM

- current affairs

Prime Minister Viktor Orbán earned nearly Ft 19 million last year and paid Ft 3 million in taxes, website Origo reported on Wednesday. Interior Minister Sándor Pintér is the highest-earning minister with close to Ft 600 million in annual revenue. Economy Minister György Matolcsy earned Ft 20 million and paid Ft 3.2 million in taxes, the site detailed.

Hungarian Parliament Has Voted On The Telecom Services Tax

- 21 May 2012 9:00 AM

- tech

The next step is taken in order to establish long term fiscal sustainability and reduce general government debt. Due to the slowing of the European economy and the protracted euro-zone crisis, the European Commission forecasts lower growth for 2012 and 2013, and therefore the government has decided to implement measures aimed at fiscal improvement.

Hungarian Government’s Decisions On System Of Taxes

- 10 May 2012 9:00 AM

- current affairs

The Government has decided to scrap the banking tax and other sectoral crisis taxes; as of the beginning of 2013, one half of the banking tax will be retained in the system, while as of 2014, this tax will be abolished altogether, Minister for National Economy György Matolcsy said on Wednesday at the Government Spokesperson’s press conference.

Colling Accounting: Personal Income Tax Changes In 2012

- 2 May 2012 6:56 AM

- specials

"Tax base top-up According to the new rules in the case of incomes below the annual gross income limit of HUF 2,424,000 the annual tax rate will remain 16%, i.e. the tax base top-up (27%) is not to be considered for the purpose of tax base. In the case of incomes above that (gross HUF 202,000 / month) the 16% personal income tax advance for the part above the limit shall be calculated for a ...

PM: IMF Can Only Use Financial Criteria When Deciding On Offering Support For Hungary

- 16 Apr 2012 9:00 AM

- current affairs

The Prime Minister confirmed press reports of his planned meeting with Mr. Barroso on 23 April, in connection with discussions between Hungary and the EU. He said that ‘Every day we move a little closer to our goal and things are going in the right direction, even though the pace is not what we might have hoped for.’

Thirty -Two Churches Recognised By Hungarian Parliament To Date

- 8 Mar 2012 8:04 AM

- current affairs

"The number of churches recognised by Parliament has risen to thirty-two. Parliament decided on the amendment of Act CCVI of 2011 on the Freedom of Conscience and Religion and the Status of Churches, Religious Denominations and Religious Communities on 27 February.

The New Hungarian Family-Friendly Tax System Boosted The Propensity To Take On More Children

- 22 Jun 2012 8:00 AM

- current affairs

The proportionate flat rate tax system has delivered the expected results. The family tax allowance introduced together with the proportionate flat rate tax stimulates families to take on more children which impact has also been manifested in the significant increase of the number of births.

EU To Lift Suspension Of EU Funds For Hungary

- 7 Jun 2012 10:55 AM

- current affairs

The European Commission recommended last week that the planned freeze of €495 million in EU cohesion fund payments to Hungary in 2013 be lifted, saying the country has taken the necessary measures to correct the excessive budget deficit. EU finance ministers, who decided in April to suspend the funds, are expected to formally confirm the EC decision on June 22.

Hungarian Gov's Response To Transparency International’s Report

- 7 Jun 2012 9:08 AM

- current affairs

Hungarian governments in the last twenty years combined have not done as much for preventing and reducing corruption and for achieving accountability as the government currently in office has in the past two years. We acknowledge with regret that this fact has been omitted from the organisation’s report, and we are therefore unable to embrace or agree with most of its findings.

Hungary's PM Orbán Earned Nearly HUF 19 Million Last Year

- 7 Jun 2012 9:00 AM

- current affairs

Prime Minister Viktor Orbán earned nearly Ft 19 million last year and paid Ft 3 million in taxes, website Origo reported on Wednesday. Interior Minister Sándor Pintér is the highest-earning minister with close to Ft 600 million in annual revenue. Economy Minister György Matolcsy earned Ft 20 million and paid Ft 3.2 million in taxes, the site detailed.

Hungarian Parliament Has Voted On The Telecom Services Tax

- 21 May 2012 9:00 AM

- tech

The next step is taken in order to establish long term fiscal sustainability and reduce general government debt. Due to the slowing of the European economy and the protracted euro-zone crisis, the European Commission forecasts lower growth for 2012 and 2013, and therefore the government has decided to implement measures aimed at fiscal improvement.

Hungarian Government’s Decisions On System Of Taxes

- 10 May 2012 9:00 AM

- current affairs

The Government has decided to scrap the banking tax and other sectoral crisis taxes; as of the beginning of 2013, one half of the banking tax will be retained in the system, while as of 2014, this tax will be abolished altogether, Minister for National Economy György Matolcsy said on Wednesday at the Government Spokesperson’s press conference.

Colling Accounting: Personal Income Tax Changes In 2012

- 2 May 2012 6:56 AM

- specials

"Tax base top-up According to the new rules in the case of incomes below the annual gross income limit of HUF 2,424,000 the annual tax rate will remain 16%, i.e. the tax base top-up (27%) is not to be considered for the purpose of tax base. In the case of incomes above that (gross HUF 202,000 / month) the 16% personal income tax advance for the part above the limit shall be calculated for a ...

PM: IMF Can Only Use Financial Criteria When Deciding On Offering Support For Hungary

- 16 Apr 2012 9:00 AM

- current affairs

The Prime Minister confirmed press reports of his planned meeting with Mr. Barroso on 23 April, in connection with discussions between Hungary and the EU. He said that ‘Every day we move a little closer to our goal and things are going in the right direction, even though the pace is not what we might have hoped for.’

Thirty -Two Churches Recognised By Hungarian Parliament To Date

- 8 Mar 2012 8:04 AM

- current affairs

"The number of churches recognised by Parliament has risen to thirty-two. Parliament decided on the amendment of Act CCVI of 2011 on the Freedom of Conscience and Religion and the Status of Churches, Religious Denominations and Religious Communities on 27 February.