498 result(s) for tax authorit

Colling Accounting: Key Changes In Hungarian Taxation For 2017

- 20 Jan 2017 8:00 AM

- specials

Personal income tax:

Changes in cafeteria style benefit plans: Owing to a reduction in tax rates and a rearrangement of items included in benefit plans, there will be a significant change in “fringe benefits”.

Changes in cafeteria style benefit plans: Owing to a reduction in tax rates and a rearrangement of items included in benefit plans, there will be a significant change in “fringe benefits”.

Europe’s Biggest Case Of Corruption Took Place In Budapest, Says Government Spokesman

- 19 Jan 2017 9:00 AM

- current affairs

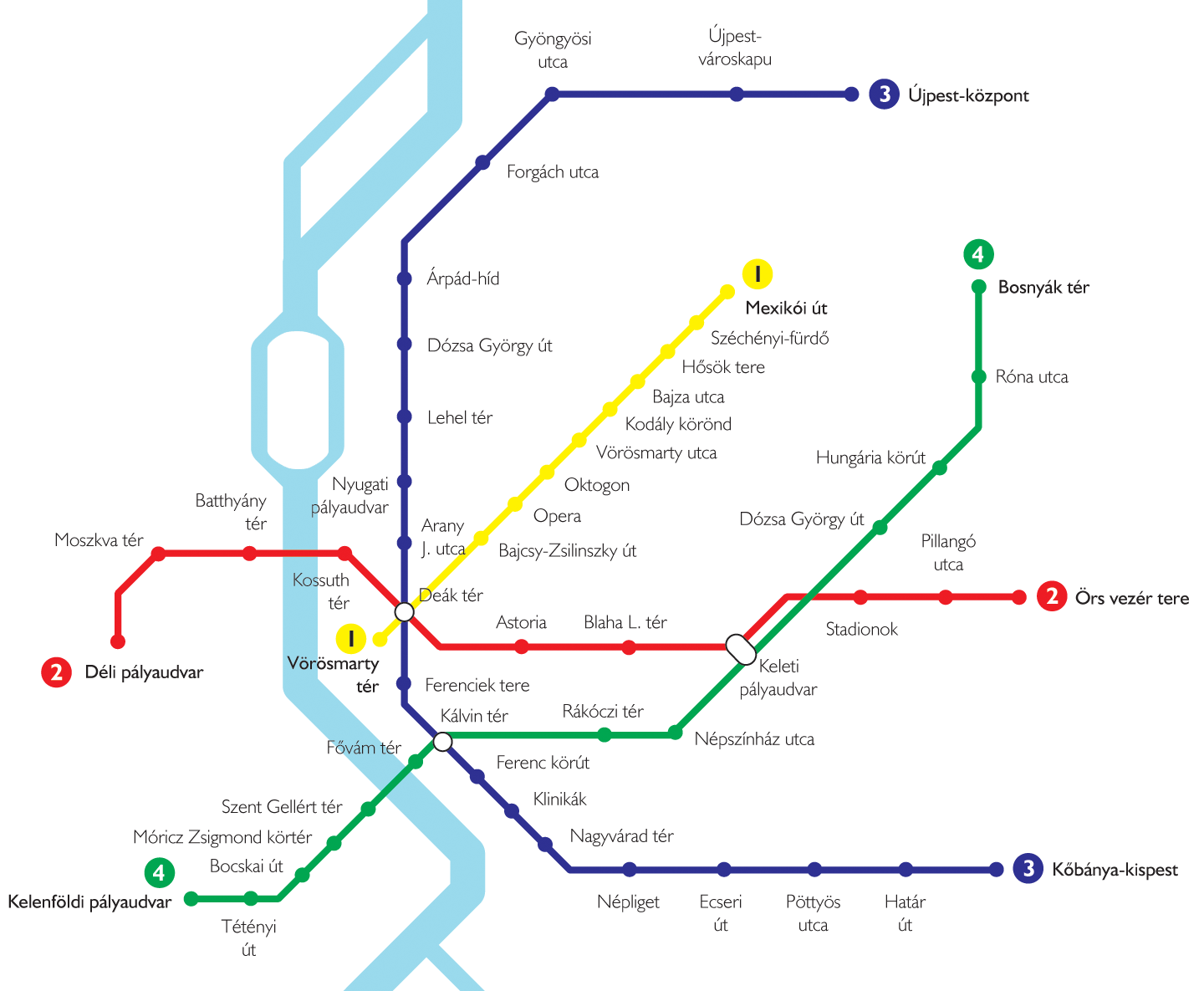

Former Budapest city mayor Gábor Demszky has called for full disclosure following last week’s announcement by Minister Overseeing the Office of the Prime Minister János Lázár that the European anti-corruption office (OLAF) was calling for the return of HUF 76.6 billion (USD 264 million) in EU funds used in the construction of the M4 subway line.

NAV Chief Suggests Hungarian Airbnb Hosts Owe Back Taxes

- 17 Jan 2017 7:40 AM

- business

Hungarians generated six billion forints of revenue from homestays organised by online peer-to-peer network Airbnb in 2015, data from the tax office in Ireland, where Airbnb is registered, show.

Europe’s Anti-Fraud Office Identifies Metro 4 Fraud

- 17 Jan 2017 7:35 AM

- current affairs

Around 167 billion forints worth of damages have been identified by Europe’s anti-fraud office OLAF in connection with Budapest’s fourth metro construction project, and the European Commission could levy a fine on Hungary of 76.6 billion forints (EUR 249m), Nándor Csepreghy, parliamentary state secretary for the prime minister’s office, told a news conference.

Hungarian Tax Authority Warns Airbnb Hosts

- 16 Jan 2017 8:00 AM

- travel

The Hungarian tax authority NAV has received data from Airbnb on the amount of income Hungarians have received from letting their homes to visitors through the online rental service.

Jobbik Demands Declaration Of Assets Owned By Politicians’ Families

- 12 Jan 2017 7:52 AM

- current affairs

The system of lawmakers obliged to submit a declaration of their assets each year is “worthless” in its current form, an MP of the radical nationalist Jobbik said on Wednesday, and demanded that the assets owned by family members should also be made public.

Registered Same-Sex Partners Entitled To Same Tax Benefits As Married Couples, Says Ombudsman

- 5 Jan 2017 7:10 AM

- business

All tax benefits such as ones for newlyweds or exemption from the inheritance tax are to be applied for registered same-sex partners, too, gay rights group Háttér Társaság said in a statement on Wednesday.

Hungary Tax Revenue Reaches EUR 41.2bn In 2016

- 4 Jan 2017 7:00 AM

- business

Hungary’s National Tax and Customs Authority (NAV) collected 12,792 billion forints (EUR 41.2bn) in revenue last year, more than 30 billion forints over the target, state secretary for tax matters András Tállai said on Tuesday.

Hungary Joins OECD Corporate Anti -Tax Evasion Initiative

- 23 Dec 2016 8:00 AM

- business

Hungary has decided to join the OECD’s Base Erosion and Profit Shifting (BEPS) framework that aims to limit tax evasion and aggressive tax optimisation by big multinational corporations, the economy ministry announced on Thursday.

Colling Accounting: Key Changes In Hungarian Taxation For 2017

- 20 Jan 2017 8:00 AM

- specials

Personal income tax:

Changes in cafeteria style benefit plans: Owing to a reduction in tax rates and a rearrangement of items included in benefit plans, there will be a significant change in “fringe benefits”.

Changes in cafeteria style benefit plans: Owing to a reduction in tax rates and a rearrangement of items included in benefit plans, there will be a significant change in “fringe benefits”.

Europe’s Biggest Case Of Corruption Took Place In Budapest, Says Government Spokesman

- 19 Jan 2017 9:00 AM

- current affairs

Former Budapest city mayor Gábor Demszky has called for full disclosure following last week’s announcement by Minister Overseeing the Office of the Prime Minister János Lázár that the European anti-corruption office (OLAF) was calling for the return of HUF 76.6 billion (USD 264 million) in EU funds used in the construction of the M4 subway line.

NAV Chief Suggests Hungarian Airbnb Hosts Owe Back Taxes

- 17 Jan 2017 7:40 AM

- business

Hungarians generated six billion forints of revenue from homestays organised by online peer-to-peer network Airbnb in 2015, data from the tax office in Ireland, where Airbnb is registered, show.

Europe’s Anti-Fraud Office Identifies Metro 4 Fraud

- 17 Jan 2017 7:35 AM

- current affairs

Around 167 billion forints worth of damages have been identified by Europe’s anti-fraud office OLAF in connection with Budapest’s fourth metro construction project, and the European Commission could levy a fine on Hungary of 76.6 billion forints (EUR 249m), Nándor Csepreghy, parliamentary state secretary for the prime minister’s office, told a news conference.

Hungarian Tax Authority Warns Airbnb Hosts

- 16 Jan 2017 8:00 AM

- travel

The Hungarian tax authority NAV has received data from Airbnb on the amount of income Hungarians have received from letting their homes to visitors through the online rental service.

Jobbik Demands Declaration Of Assets Owned By Politicians’ Families

- 12 Jan 2017 7:52 AM

- current affairs

The system of lawmakers obliged to submit a declaration of their assets each year is “worthless” in its current form, an MP of the radical nationalist Jobbik said on Wednesday, and demanded that the assets owned by family members should also be made public.

Registered Same-Sex Partners Entitled To Same Tax Benefits As Married Couples, Says Ombudsman

- 5 Jan 2017 7:10 AM

- business

All tax benefits such as ones for newlyweds or exemption from the inheritance tax are to be applied for registered same-sex partners, too, gay rights group Háttér Társaság said in a statement on Wednesday.

Hungary Tax Revenue Reaches EUR 41.2bn In 2016

- 4 Jan 2017 7:00 AM

- business

Hungary’s National Tax and Customs Authority (NAV) collected 12,792 billion forints (EUR 41.2bn) in revenue last year, more than 30 billion forints over the target, state secretary for tax matters András Tállai said on Tuesday.

Hungary Joins OECD Corporate Anti -Tax Evasion Initiative

- 23 Dec 2016 8:00 AM

- business

Hungary has decided to join the OECD’s Base Erosion and Profit Shifting (BEPS) framework that aims to limit tax evasion and aggressive tax optimisation by big multinational corporations, the economy ministry announced on Thursday.