Hungarian Households Act Mysteriously

- 23 Aug 2010 1:00 AM

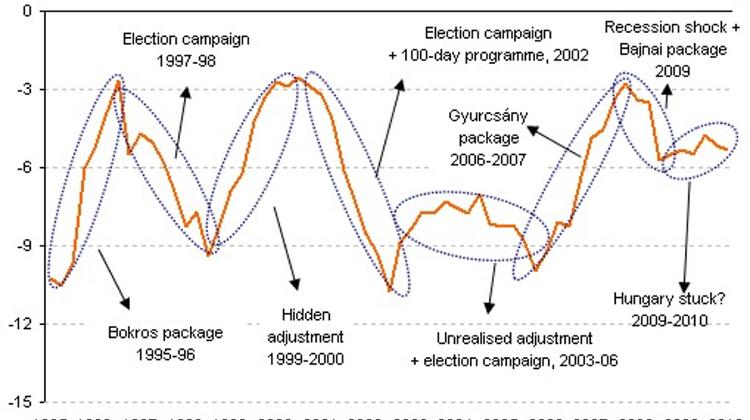

Hungary’s net financing requirement remained high at 5.3% of GDP in Q2, according to seasonally adjusted data. The deficit seems to be stuck between 4.5% and 5.5%, which is confirmed by the fact that the country’s general government net borrowing was equal to 4.8% of GDP in the year to end-June.

Looking at the numbers we may carefully draw the conclusion that the government may need additionally measures to meet the 3.8% of GDP deficit target, although the macroeconomic numbers do not even hint at major spending increases before the municipal elections (3 Oct).

The central bank noted that "the figures of the central government balance still do not include the effects of the legislative changes concerning taxation, taking effect during the second half of 2010." According to the independent Budget Council’s calculations, the impact could be 0.3-0.4% of GDP this year.

But this does not change the fact that with a deficit this large, government debt cannot be put on a declining track, perhaps not even with higher growth. General government consolidated gross debt at nominal value amounted to 82.9% of GDP at the end of the second quarter. While a lot of factors have an impact on mid-year numbers, if the gap is not reduced to below 4%, the government will certainly not be able to say the debt is and will remain on a declining path.

The foreboding figures on the public sector were published together with data on households, where the main number caused quite a surprise. Net financing capacity of households jumped to 9.8% of GDP (according to seasonally adjusted data) from 3.2% in Q1. We have not seen a figure this high since the late 1990s. This is basically a favourable development since the rise in domestic funds reduces the country’s dependence on foreign capital (mostly loans). And in the longer term it may lower the national economy’s external debt substantially.

An income cycle in the national economy is ideal when household savings finance - via the financial intermediary system - corporate investments and possibly the public sector deficit (of a tolerable size). Otherwise the state gets into debt. As corporates are "self-propelled" as their business cycles go, the combined position of households and the general government deserves special interest.

The financing capacity of the two sectors combined was 4.5% of GDP, which means household savings are not consumed by the financing requirement of the public sector. The last time we witnessed that was in 2011, and there has not been such a large positive balance since 1996. (Or more precisely, we would have seen it if economists had not collected the relevant data only retroactively.)

The most interesting thing about the whole situation is that nothing extraordinary happened in the second quarter that would have caused such a shock-like jump in net savings. We should suspect this is an accidental, one-off phenomenon, but even a close scrutiny of the numbers has not showed us a single factor that we could attribute such a leap in the index to. It was most likely the consequence of the combined impact of several factors, which then may indicate a persistent phenomenon.

An increase in net savings can be observed when (a) households start to save up more income than before or (2) their inclination to borrow declines. In this case, both are true. A decrease in borrowing activity is no surprise, as it has started more than 18 months ago. Banks are trying to lower their loan-to-deposit ratio; households burnt their hands badly with foreign exchange loans and regulations have become a lot stricter.

Households repaid HUF 445 bn of FX debt over the past year, HUF 185 bn of that in Q2. Needless to say, we have not seen anything even close to that ever. While forint loans have become a bit more popular (their volume has not been this big for six years), but these can only slow down and not turn around the debt accumulation of households.

What is even more interesting is that the gross savings of households started climb much faster than usual. Financial assets (from transactions) grew HUF 380 bn in Q2, which is impressive compared to the previous quarters (e.g. Q1: HUF 87 bn), but not outstanding. Besides a rise in currency and deposits, it is noteworthy that more modern investment vehicles, such as shares and other equities have become more popular.

Household net lending amounted to nearly HUF 500 bn in Q2 and HUF 1,257 bn (4.7% of GDP) in the four quarters to end-June. Due to their high FX exposure, this cautious behaviour is indeed warranted. Exchange rate fluctuations lead to serious revaluations in loans that had already been taken out. Total household debt grew by HUF 1,000 bn only because of that in Q2. This, of course, is an unrealised loss, but could easily become realised loss (in the form of high monthly instalments) without a correction in exchange rates."

LATEST NEWS IN current affairs