Look At What’s Happening To Inflation In Hungary, By Ferenc Kumin

- 18 Mar 2013 8:00 AM

Experts agree that the Hungarian forint’s drop in value over the last fortnight reflects mostly the market uncertainty regarding the change in leadership at Hungarian Central Bank. For the most part, that’s normal and healthy for the market to react to change, especially in times of a financial crisis. As the new MNB governor, however, Mr. Matolcsy, who as minister focused on decreasing debt and slashing the deficit, and MNB deputy head, Ádám Balog, have emphasized that Hungary will maintain a cautious approach to monetary policy.

Less healthy, though, is when an unverified rumor, which defies common sense, goes unquestioned. Despite some recent reports, the Government of Hungary is not interested in a weakening forint, and that’s been made clear several times, recently by Minister of Economics Varga, Minister of Foreign Affairs Martonyi and others.

In addition to these clear statements, one may look at Hungary’s debt level, which remains high in foreign currencies. An exposed country with such a high level of foreign debt has to watch FX changes closely. Simply, risking the consequences of increasing debt, especially the public and private costs of debt servicing, significantly offset the potential gain in revenues.

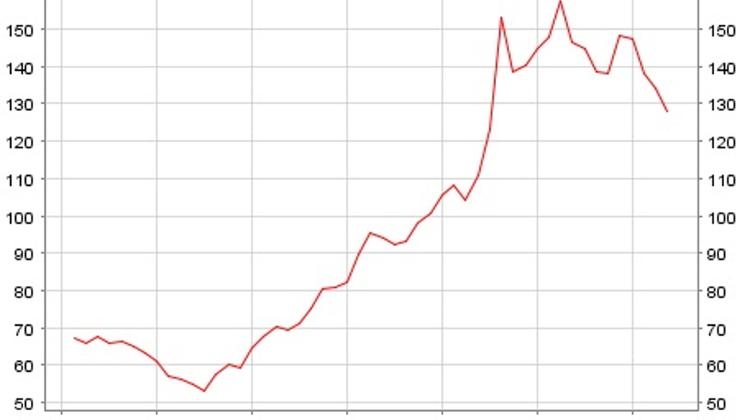

In the meantime, inflation in Hungary is coming down. According to the latest data, it’s at a seven-year low due to cuts in energy prices. So is the yield on state bonds as of this January. A lot more to be done, especially on the growth front, but these are encouraging fundamental indicators.

LATEST NEWS IN business