"Lowered At Temporarily Faster Pace” - Central Bank Cuts Base Rate in Hungary Down To 9%

- 28 Feb 2024 7:09 AM

- Hungary Matters

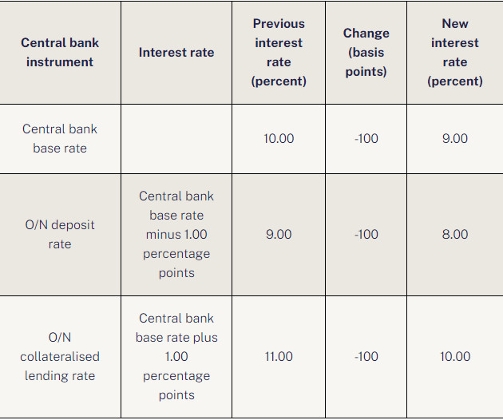

The Council also decided to lower the symmetric interest rate corridor in tandem, bringing the O/N deposit rate to 8.00% and the O/N collateralised loan rate to 10.00%.

The Council said disinflation had been “stronger than expected”, external and domestic demand pressures remained “persistently low”, and Hungary’s risk perception had improved further as the current account balance improved.

“This allows the base rate to be lowered at a temporarily faster pace,” the Council added.

At an online press conference after the meeting, central bank deputy governor Barnabás Virág said lower than expected inflation and improved risk perceptions had allowed for the “temporary” acceleration in the easing cycle from 75bp cuts at the previous policy meetings.

He added that the inflation path was now about half a percentage point lower than the central bank’s earlier short-term forecast.

Virág said the Council’s expectation for the mid-year interest rate level was unchanged. He added that market players’ expectations for an interest rate level of 6-7% at the end of the first half appeared “realistic”.

He said the Council continued to take a “data-driven” approach and noted the importance of the March Inflation Report in determining the pace of the easing cycle in the second quarter.

Click here for the full report

*********************************************************************************

You're very welcome to comment, discuss and enjoy more stories, via our Facebook page:

Facebook.com/XpatLoopNews + via XpatLoop’s groups: Budapest Expats / Expats Hungary

You can subscribe to our newsletter here:

XpatLoop.com/Newsletters

Do you want your business to reach tens of thousands of potential high-value expat customers?

Then just contact us here!

LATEST NEWS IN finance