484 result(s) for employer

CEU Career Days, Budapest, 10 - 11 May

- 2 May 2012 7:00 AM

- specials

The CEU Career Fair, organized since 2001, has been a great opportunity for companies from around the world to meet outstanding students and aims to offer students the possibility to meet face-to-face with company representatives, through on-campus recruiting, interviews and interactive presentations.

Colling Accounting: Personal Income Tax Changes In 2012

- 2 May 2012 6:56 AM

- specials

"Tax base top-up According to the new rules in the case of incomes below the annual gross income limit of HUF 2,424,000 the annual tax rate will remain 16%, i.e. the tax base top-up (27%) is not to be considered for the purpose of tax base. In the case of incomes above that (gross HUF 202,000 / month) the 16% personal income tax advance for the part above the limit shall be calculated for a ...

Hungary's PM Orbán: The Guarantors Of Success Are Job Creation And Businesses

- 13 Mar 2012 8:00 AM

- business

"At the handover ceremony for the new production hall at Linamar Corporation in Orosháza, Prime Minister Viktor Orbán said that support for businesses and job creation will be the guarantors of Hungary’s success. Linamar, which produces agricultural machinery and parts for the auto industry, has built a new production hall at a cost of HUF 6.9 bn and has thus provided 250 new jobs.

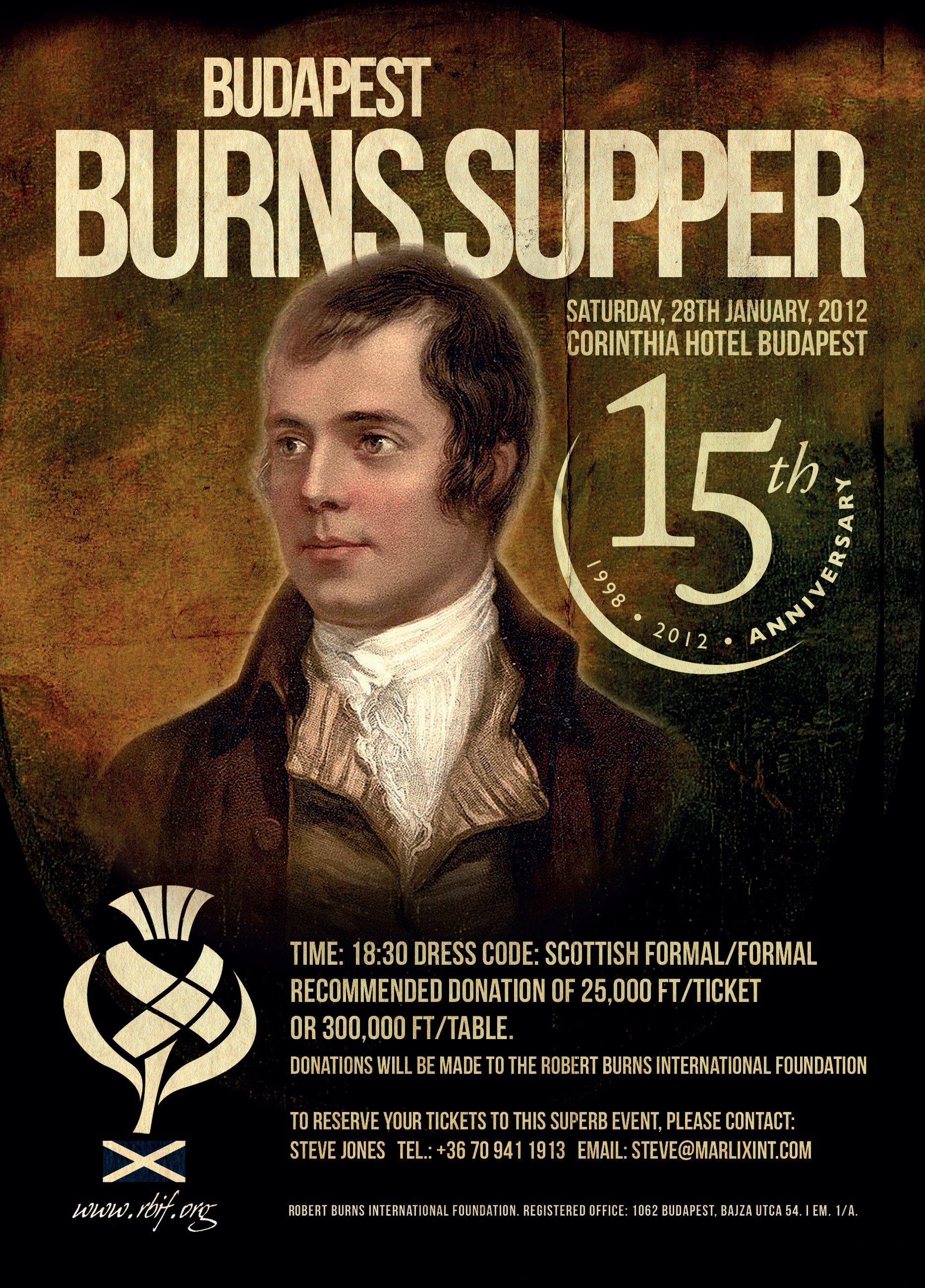

Tesco Named RBIF Sponsor Of The Year In Hungary By Robin Marshall

- 24 Jan 2012 8:06 AM

- community & culture

The name of the Robert Burns International Foundation Sponsor of the Year was revealed to a crowd of 75,000 on January 14, 2012, with Sir Alex Ferguson, manager of Manchester United Football Club, and the RBIF’s Honorary President, presenting the trophy to David Wood, commercial director of Tesco Global Áruházak Zrt.

Colling Accounting: Review Of The Changes In The Corporation Tax In Respect Of 2012

- 11 Jan 2012 5:00 AM

- specials

Limitation of the use of accrued loss - One of the most important changes, impacting a wide range of taxpayers, is that the accrued loss carried forward from previous tax years can be recognised as an item reducing the profit before tax up to 50% of the tax base (calculated without the accrued loss).

Colling Accounting: Changes In Hungarian Tax Legislation 2011

- 17 Dec 2010 2:00 AM

- specials

"2011 is the year of tax legislation changes, as tax laws this year have changed even more frequently than in previous years. Instead of – sometimes necessary, but often inspired by sudden ideas and consequently brush-fire nature (often surviving only for one year) – austerity measures taken in previous years, we can now witness the fundaments of an entirely different system taking form, which ...

Hungarian Government Evaluates Own Performance

- 8 Dec 2010 12:00 AM

- current affairs

Continued support post-election is virtually unheard of in Hungary, according to analysts, but the Government has kept its two-thirds majority fully intact, several recent polls show.

Special Interview: Botond Melles, Country Manager Hungary, Air France KLM Delta

- 7 Dec 2010 12:00 AM

- travel

Mr Melles has been the Country Manager in Hungary for Air France KLM since August 2009. Originally from Székesfehérvár, he was born on 5 January, and attended the Teleki Blanka Gimnazium until 1998. He went on to read Business Studies at the International Business School in Budapest. He then starting his fast-track career with Nestle in the summer of 2002.

Hungarian Gov’t Scraps 2nd Pension System Pillar

- 30 Nov 2010 12:00 AM

- current affairs

"The government has set January 31, 2011 as the deadline for private pension fund members to return to the state pension scheme or face losing their pension entitlements from the state.

CEU Career Days, Budapest, 10 - 11 May

- 2 May 2012 7:00 AM

- specials

The CEU Career Fair, organized since 2001, has been a great opportunity for companies from around the world to meet outstanding students and aims to offer students the possibility to meet face-to-face with company representatives, through on-campus recruiting, interviews and interactive presentations.

Colling Accounting: Personal Income Tax Changes In 2012

- 2 May 2012 6:56 AM

- specials

"Tax base top-up According to the new rules in the case of incomes below the annual gross income limit of HUF 2,424,000 the annual tax rate will remain 16%, i.e. the tax base top-up (27%) is not to be considered for the purpose of tax base. In the case of incomes above that (gross HUF 202,000 / month) the 16% personal income tax advance for the part above the limit shall be calculated for a ...

Hungary's PM Orbán: The Guarantors Of Success Are Job Creation And Businesses

- 13 Mar 2012 8:00 AM

- business

"At the handover ceremony for the new production hall at Linamar Corporation in Orosháza, Prime Minister Viktor Orbán said that support for businesses and job creation will be the guarantors of Hungary’s success. Linamar, which produces agricultural machinery and parts for the auto industry, has built a new production hall at a cost of HUF 6.9 bn and has thus provided 250 new jobs.

Tesco Named RBIF Sponsor Of The Year In Hungary By Robin Marshall

- 24 Jan 2012 8:06 AM

- community & culture

The name of the Robert Burns International Foundation Sponsor of the Year was revealed to a crowd of 75,000 on January 14, 2012, with Sir Alex Ferguson, manager of Manchester United Football Club, and the RBIF’s Honorary President, presenting the trophy to David Wood, commercial director of Tesco Global Áruházak Zrt.

Colling Accounting: Review Of The Changes In The Corporation Tax In Respect Of 2012

- 11 Jan 2012 5:00 AM

- specials

Limitation of the use of accrued loss - One of the most important changes, impacting a wide range of taxpayers, is that the accrued loss carried forward from previous tax years can be recognised as an item reducing the profit before tax up to 50% of the tax base (calculated without the accrued loss).

Colling Accounting: Changes In Hungarian Tax Legislation 2011

- 17 Dec 2010 2:00 AM

- specials

"2011 is the year of tax legislation changes, as tax laws this year have changed even more frequently than in previous years. Instead of – sometimes necessary, but often inspired by sudden ideas and consequently brush-fire nature (often surviving only for one year) – austerity measures taken in previous years, we can now witness the fundaments of an entirely different system taking form, which ...

Hungarian Government Evaluates Own Performance

- 8 Dec 2010 12:00 AM

- current affairs

Continued support post-election is virtually unheard of in Hungary, according to analysts, but the Government has kept its two-thirds majority fully intact, several recent polls show.

Special Interview: Botond Melles, Country Manager Hungary, Air France KLM Delta

- 7 Dec 2010 12:00 AM

- travel

Mr Melles has been the Country Manager in Hungary for Air France KLM since August 2009. Originally from Székesfehérvár, he was born on 5 January, and attended the Teleki Blanka Gimnazium until 1998. He went on to read Business Studies at the International Business School in Budapest. He then starting his fast-track career with Nestle in the summer of 2002.

Hungarian Gov’t Scraps 2nd Pension System Pillar

- 30 Nov 2010 12:00 AM

- current affairs

"The government has set January 31, 2011 as the deadline for private pension fund members to return to the state pension scheme or face losing their pension entitlements from the state.