426 result(s) for income tax

Colling Accounting: Changes In Hungarian Tax Legislation 2011

- 17 Dec 2010 2:00 AM

- specials

"2011 is the year of tax legislation changes, as tax laws this year have changed even more frequently than in previous years. Instead of – sometimes necessary, but often inspired by sudden ideas and consequently brush-fire nature (often surviving only for one year) – austerity measures taken in previous years, we can now witness the fundaments of an entirely different system taking form, which ...

Hungarian Parliament Guts Budget Council

- 7 Dec 2010 12:01 AM

- current affairs

"The Budget Council was deprived of its staff and budget in a vote in Parliament yesterday. The new Council will consist of three members working free of charge, as the independent body’s budget has been cut to zero. Those three will be the governor of the National Bank, the head of the State Audit Office and an economist appointed by the President for six years.

Bank Sector In Hungary Losing Its Competitiveness

- 24 Nov 2010 1:00 AM

- business

"The bank tax, the freeze on foreclosures and the strong Swiss franc have depressed Hungarian banks’ income-generating capacity to the extent that their ability to contribute to economic growth will decline, the national bank MNB warned in its quarterly report on financial stability.

Hungarian Gov’t To Tax Severance Pay Since 2005

- 10 Nov 2010 12:00 AM

- current affairs

"The government will make the 98% tax on severance pay above a certain sum retroactive to 2005, under a proposal put forward yesterday by caucus leader János Lázár. The Constitutional Court struck down the 98% tax last month, in part because it had retroactive effect to the beginning of 2010.

Public Statement By American Chamber of Commerce In Hungary On Recent Government Economic Initiatives

- 10 Nov 2010 12:00 AM

- business

"The significance to the business environment warrants that AmCham comment on recent government economic initiatives.

Hungarian Gov’t To Launch 16% Flat Tax In 2013

- 28 Sep 2010 1:00 AM

- property

"The tension on the money markets over Hungary's finances could ease in October, which will be beneficial to the forint-Swiss franc exchange rate, state secretary of the Economy Ministry Andras Karman said in an interview to Magyar Nemzet.

Hungarian Households Act Mysteriously

- 23 Aug 2010 1:00 AM

- business

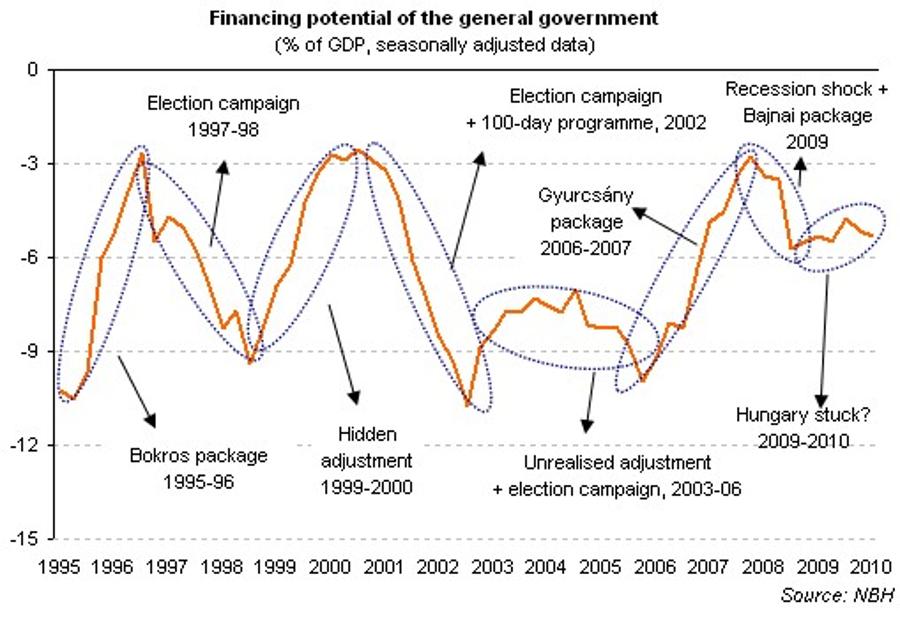

"Hungary’s budget is not on the right tract, gross government debt is already 83% of gross domestic product, while households started to save up surprisingly vehemently and abruptly, these are the main features the central bank’s (NBH) latest report on financial accounts showed.

Key Changes Of Hungary's Tax Legislation For Companies

- 12 Aug 2010 2:00 AM

- business

"On 22 July 2010, the Hungarian Parliament adopted the most recent legislation package amending certain financial laws. In its latest Tax & Legal Alert, PricewaterhouseCoopers has summarized the most important amendments of the package concerning companies as follows.

Rate Makes Hungary A Tax Haven

- 5 Aug 2010 2:00 AM

- business

"The new 10% corporate tax rate for companies with annual revenues of up to Ft 500 million qualifies Hungary as a tax haven, local business media reported.

Colling Accounting: Changes In Hungarian Tax Legislation 2011

- 17 Dec 2010 2:00 AM

- specials

"2011 is the year of tax legislation changes, as tax laws this year have changed even more frequently than in previous years. Instead of – sometimes necessary, but often inspired by sudden ideas and consequently brush-fire nature (often surviving only for one year) – austerity measures taken in previous years, we can now witness the fundaments of an entirely different system taking form, which ...

Hungarian Parliament Guts Budget Council

- 7 Dec 2010 12:01 AM

- current affairs

"The Budget Council was deprived of its staff and budget in a vote in Parliament yesterday. The new Council will consist of three members working free of charge, as the independent body’s budget has been cut to zero. Those three will be the governor of the National Bank, the head of the State Audit Office and an economist appointed by the President for six years.

Bank Sector In Hungary Losing Its Competitiveness

- 24 Nov 2010 1:00 AM

- business

"The bank tax, the freeze on foreclosures and the strong Swiss franc have depressed Hungarian banks’ income-generating capacity to the extent that their ability to contribute to economic growth will decline, the national bank MNB warned in its quarterly report on financial stability.

Hungarian Gov’t To Tax Severance Pay Since 2005

- 10 Nov 2010 12:00 AM

- current affairs

"The government will make the 98% tax on severance pay above a certain sum retroactive to 2005, under a proposal put forward yesterday by caucus leader János Lázár. The Constitutional Court struck down the 98% tax last month, in part because it had retroactive effect to the beginning of 2010.

Public Statement By American Chamber of Commerce In Hungary On Recent Government Economic Initiatives

- 10 Nov 2010 12:00 AM

- business

"The significance to the business environment warrants that AmCham comment on recent government economic initiatives.

Hungarian Gov’t To Launch 16% Flat Tax In 2013

- 28 Sep 2010 1:00 AM

- property

"The tension on the money markets over Hungary's finances could ease in October, which will be beneficial to the forint-Swiss franc exchange rate, state secretary of the Economy Ministry Andras Karman said in an interview to Magyar Nemzet.

Hungarian Households Act Mysteriously

- 23 Aug 2010 1:00 AM

- business

"Hungary’s budget is not on the right tract, gross government debt is already 83% of gross domestic product, while households started to save up surprisingly vehemently and abruptly, these are the main features the central bank’s (NBH) latest report on financial accounts showed.

Key Changes Of Hungary's Tax Legislation For Companies

- 12 Aug 2010 2:00 AM

- business

"On 22 July 2010, the Hungarian Parliament adopted the most recent legislation package amending certain financial laws. In its latest Tax & Legal Alert, PricewaterhouseCoopers has summarized the most important amendments of the package concerning companies as follows.

Rate Makes Hungary A Tax Haven

- 5 Aug 2010 2:00 AM

- business

"The new 10% corporate tax rate for companies with annual revenues of up to Ft 500 million qualifies Hungary as a tax haven, local business media reported.