Hungary Central Bank Raises Base Rate 50 Basis Points

- 23 Feb 2022 8:35 AM

- Hungary Matters

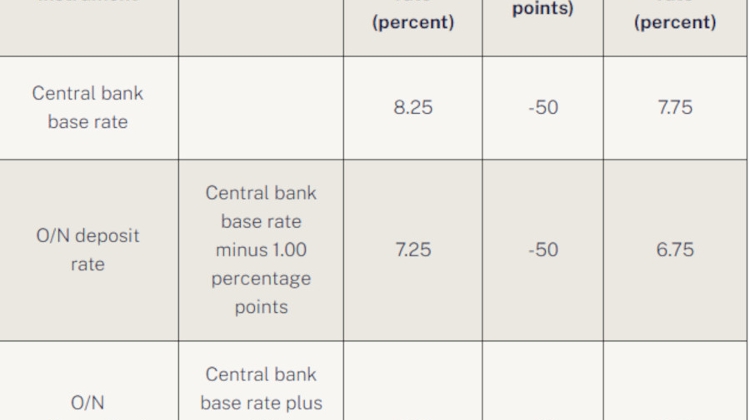

The Monetary Council also expanded the interest rate corridor by the same extent.

In a statement released after the meeting, the Council said “the risks to the outlook for inflation have increased and continue to be on the upside”, while “persistently high” commodity, crop, food and energy prices and elevated international freight costs “continue to point to sustained external inflationary pressures”.

The tight labour market, coupled with accelerating wage growth and a higher inflation environment, “may lead to a further rise in inflation expectations and an increase in second-round inflation risks”, it added.

Headline inflation “will begin to decline later than previously expected” while core inflation “may pick up further in the coming months”, the Council said.

The policymakers said companies are repricing goods and services “at relatively short notice” amid strong domestic demand, as well as higher commodity prices and wage costs.

“The degree to which repricings take place in the coming months will determine the yearly dynamics of both inflation and core inflation,” they added.

The Council said inflation risks warrant a further tightening of monetary conditions, adding that they deem it “necessary to continue the base rate tightening cycle on a monthly basis while gradually raising it to the level of the one-week deposit rate”.

“The Monetary Council will continue the cycle of interest rate hikes until the outlook for inflation stabilises around the central bank target and inflation risks become evenly balanced on the horizon of monetary policy,” the policy makers reiterated.

At a press conference after the meeting, National Bank of Hungary deputy governor Barnabás Virág said headline CPI in February “could be close to 8.5%”.

He said “broad” repricing of goods services is taking place at a “much higher scale than usual”, noting that the degree of repricing in January was “three times” the normal.

He also pointed to strengthening geopolitical risks, continued high volatility on markets and the start of tightening cycles by big central banks among factors that necessitate the continued, predictable tightening of monetary conditions in Hungary.

Virág acknowledged the dampening effect of government price caps on vehicle fuel and some staple foods, as well as the regulated utilities price scheme for households, on pass-through of global commodity price rises to domestic inflation.

LATEST NEWS IN finance