Central Bank in Hungary Raises Base Rate to 4.40% Due to Increased Inflation Risks

- 23 Mar 2022 7:54 AM

- Hungary Matters

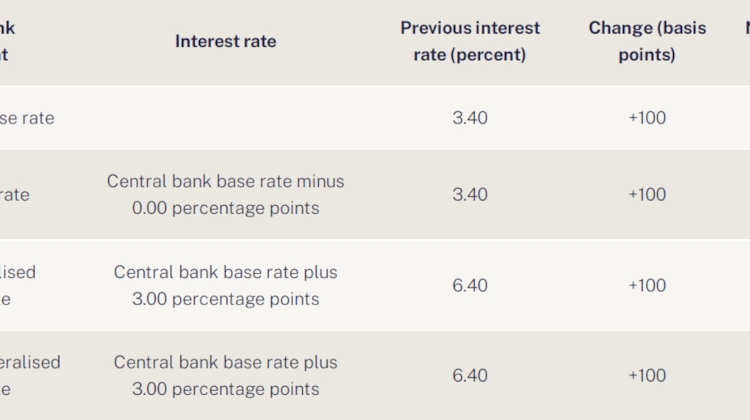

The members of the Monetary Council also decided to raise the O/N deposit rate by 100 basis points to 4.40% and the O/N and one-week collateralised loan rates by 100 basis points to 7.40%.

The O/N deposit rate and the collateralised loan rate mark the bottom and the top, respectively, of the central bank’s “interest rate corridor”. The base rate is paid on mandatory reserves.

In a statement released after the meeting, the Council said the Russia-Ukraine war has “posed a much higher risk than usual” to the outlook for inflation. The increase in inflation risks warrants a further tightening of monetary conditions.

Consequently, the Monetary Council deems it necessary to continue the general tightening of monetary conditions and to continue the base rate tightening cycle by a larger increment than before, it added.

The Council said strong negative supply effects were likely to raise inflation in the coming quarter, while higher energy and commodity prices boost inflation further on the expenditure side.

Inflation is likely to decline in the second half of the year, the policy makers said, adding that the short-term path of inflation “will depend on the duration of the war, the extent and persistence of sanctions, as well as government responses”.

The central bank raised its average annual inflation forecast for 2022 to 7.5-9.8%, but said CPI is expected to return to the +/-1 percentage point tolerance band around the mid-term 3.0% target in the second half of 2023 and reach the target in the first half of 2024.

The NBH augurs a slowdown in GDP growth to 2.5-4.5% in 2022, depending on the duration of the war and the policy of sanctions.

Click here for the whole report

LATEST NEWS IN finance