Market for Private Schools in Hungary Developing Dynamically

- 1 Oct 2024 2:18 PM

- Budapest Business Journal

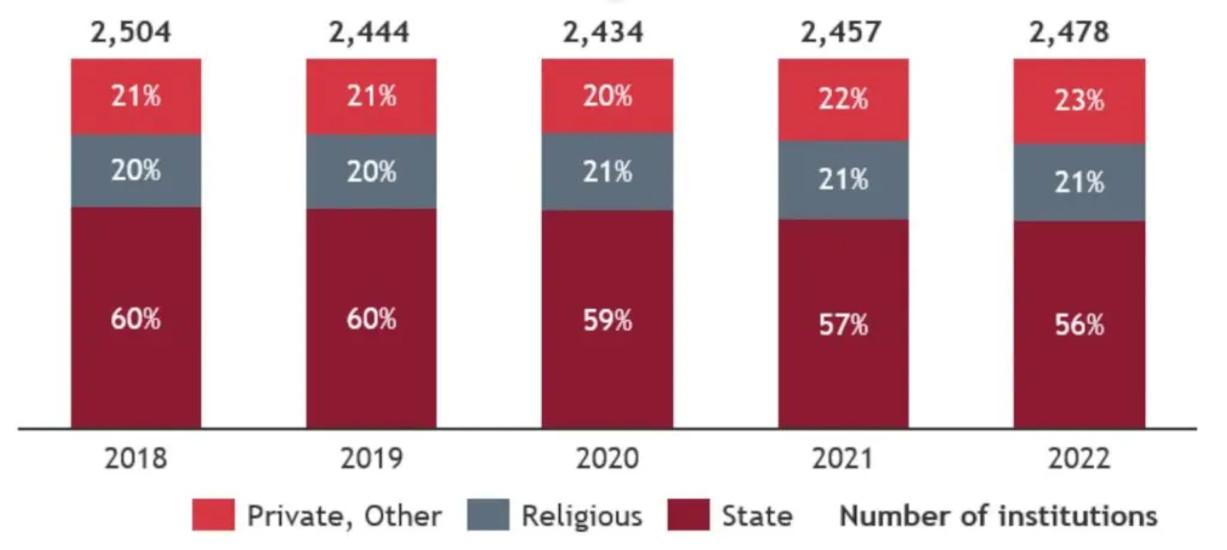

Between 2020 and 2023, the number of students enrolled in private institutions increased from 59,000 to 64,000. The importance of private education institutions increased during this period, with 23% of secondary education institutions in Hungary being either foundation-run or private in the academic year 2022-2023.

In recent years, the market for private schools in Hungary has developed dynamically. While demand is growing rapidly, the supply of private education options has not yet caught up, resulting in most existing institutions operating at full capacity, and longer waiting lists.

This trend is further strengthened by the infrastructural development of private educational institutions, their readiness in the field of digitalization and the continuous increase in demand for modern pedagogical methods.

In a detailed market analysis, the team of BDO Corporate Finance surveyed 28 educational institutions within the Hungarian private school sector, identifying 10 as Hungarian and 18 as International schools.

Among these, 46% (13 institutions) offer education from kindergarten through high school (ages 3-18), while 10 cater to both primary and high school students, and five focus exclusively on high school education.

Increasing Demand for Private Education

Several new private schools have been established in Hungary in recent years. Data from the Association of Foundation and Private Schools (AME) indicates that over 20 new foundation and private schools have launched since 2018.

Notable new entrants include the Diákszempont Primary and High School, which opened in 2019, and the Budapest School network, which has established several micro-schools, as those in Solymár (2018) and Érd (2020).

Furthermore, existing institutions are planning to expand their capacities or are even considering the creation of new campuses.

There is a significant variation in tuition fees between the institutions surveyed. International schools, on average, charge HUF 4.3 million per year, while Hungarian institutions have significantly lower average annual tuition fees of HUF 1.5 million. Even within the international schools, there are major disparities.

The two largest international private schools (AISB and BISB) charge as much as HUF 9 million annually for the final years of education.

In terms of the institutions surveyed, the average annual revenue of organizations operating Hungarian private schools is HUF 767 mln, while that International private institutions generate more than HUF 1 bln annually, according to a study by BDO Corporate Finance.

Despite having fewer students on average, International schools typically generate higher revenues, with the largest schools standing out both in terms of student numbers and financial performance.

Opportunities for Strategic Investment in the Hungarian Private Education Market

BDO’s survey highlights significant growth potential within the sector, driven by increasing demand for high-quality private education that continues to outpace current supply. As more families seek alternative options to public schooling, the Hungarian private school market emerges as a promising landscape for strategic investment by both established operators and new entrants.

This trend presents a unique opportunity for investors to capitalize on the expanding demand, whether by acquiring an existing school or establishing a new institution to meet the growing market needs.

For more information and to download the full study, please visit the BDO Corporate Finance website.

*********************************

You're very welcome to comment, discuss and enjoy more stories via our Facebook page:

Facebook.com/XpatLoopNews + via XpatLoop’s groups: Budapest Expats / Expats Hungary

You can subscribe to our newsletter here: XpatLoop.com/Newsletters

Do you want your business to reach tens of thousands of potential high-value expat customers? Then just contact us here!

LATEST NEWS IN getting around