8 result(s) for sustainable energy policy in Finance

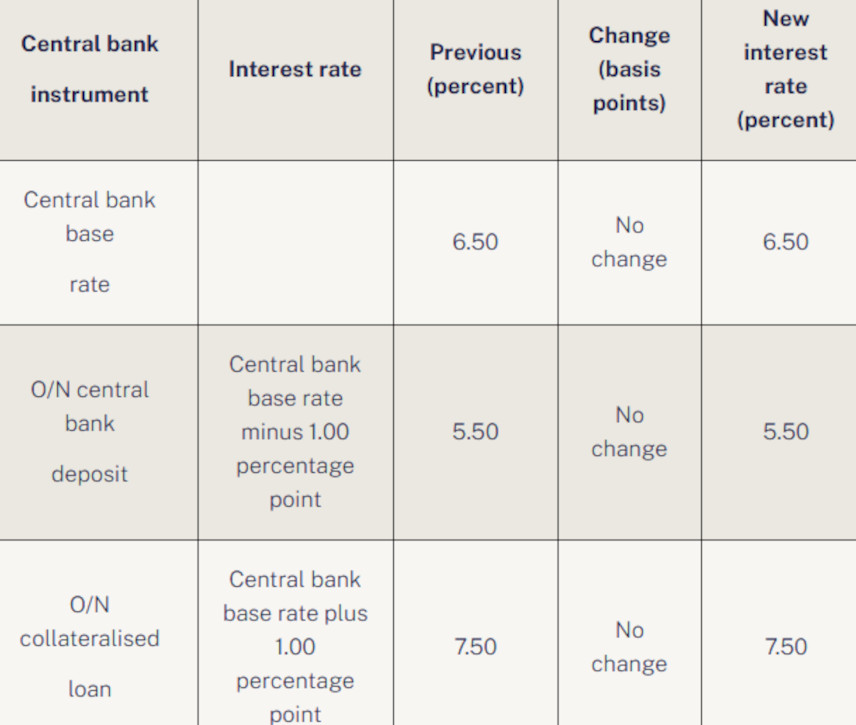

Analysis: National Bank Base Rate Kept on Hold in Hungary at 6.5%

- 28 May 2025 7:46 AM

- finance

The Monetary Council of the National Bank of Hungary (NBH) decided to leave the central bank base rate unchanged at 6.50pc at a monthly policy meeting on Tuesday.

Updated: NBH Sees Inflation Slowing Further in September in Hungary

- 27 Sep 2024 6:00 AM

- finance

August's 3.4pc CPI was in line with the National Bank of Hungary's expectations, and the central bank sees inflation falling to 3.1pc in September, Andras Balatoni, an NBH director said.

Top Performance for Environmental, Social & Governance: CIB Bank Awarded ‘Best Bank for ESG’ in Hungary

- 8 Aug 2024 7:05 AM

- https://bbj.hu/

- finance

CIB Bank has been awarded the "Best Bank for ESG" accolade by Euromoney financial magazine, recognizing its leadership in sustainable banking and bank insurance services in Hungary.

Here's Why Base Rate to Remain High in Hungary at 13%

- 1 Mar 2023 6:49 AM

- hungarymatters.hu

- finance

Hungarian rate-setters decided to leave the base rate unchanged at 13% at a regular policy meeting on Tuesday.

13% Base Rate Kept on Hold in Hungary

- 25 Jan 2023 10:29 AM

- hungarymatters.hu

- finance

Hungarian rate-setters decided to keep the base rate on hold at 13% at a regular policy meeting on Tuesday, the first such meeting this year.

Watch: EC Says Reforms by Hungary Not Enough to Get All Withheld EU Funds

- 1 Dec 2022 6:38 AM

- hungarymatters.hu

- finance

The European Commission believes the reforms undertaken by Budapest so far to ensure EU money is not misused did not go far enough.

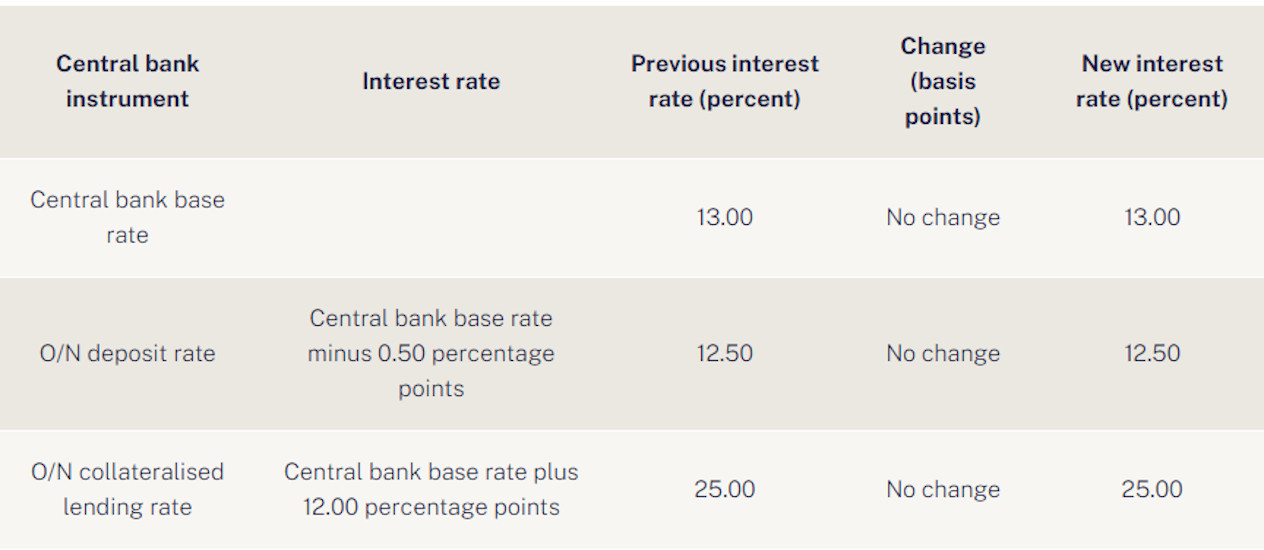

Central Bank Keeps Base Rate at 13%

- 23 Nov 2022 8:55 AM

- hungarymatters.hu

- finance

Hungarian rate-setters left the base rate on hold at 13% at a regular policy meeting. The Council also decided on Tuesday to keep the central bank’s O/N deposit rate at 12.50% and the O/N collateralised loan rate at 25%.

Base Rate Raised Again by Central Bank in Hungary - Extraordinary Measures Explained

- 27 Jul 2022 11:35 AM

- hungarymatters.hu

- finance

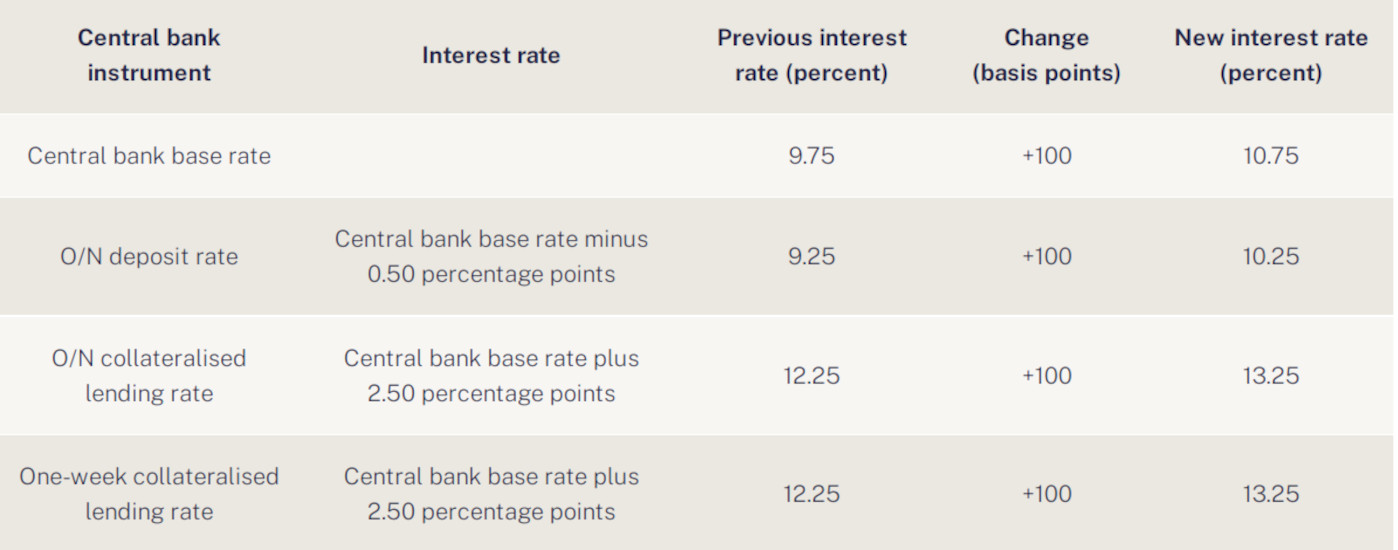

NBH rate-setters raised the base rate by 100 basis points to 10.75% this Tuesday. The Monetary Council had raised the base rate by 200 basis points to 9.75% just two weeks earlier, taking the extraordinary measure at a non-rate-setting meeting to keep the key rate in tandem with the one-week deposit rate.

Analysis: National Bank Base Rate Kept on Hold in Hungary at 6.5%

- 28 May 2025 7:46 AM

- finance

The Monetary Council of the National Bank of Hungary (NBH) decided to leave the central bank base rate unchanged at 6.50pc at a monthly policy meeting on Tuesday.

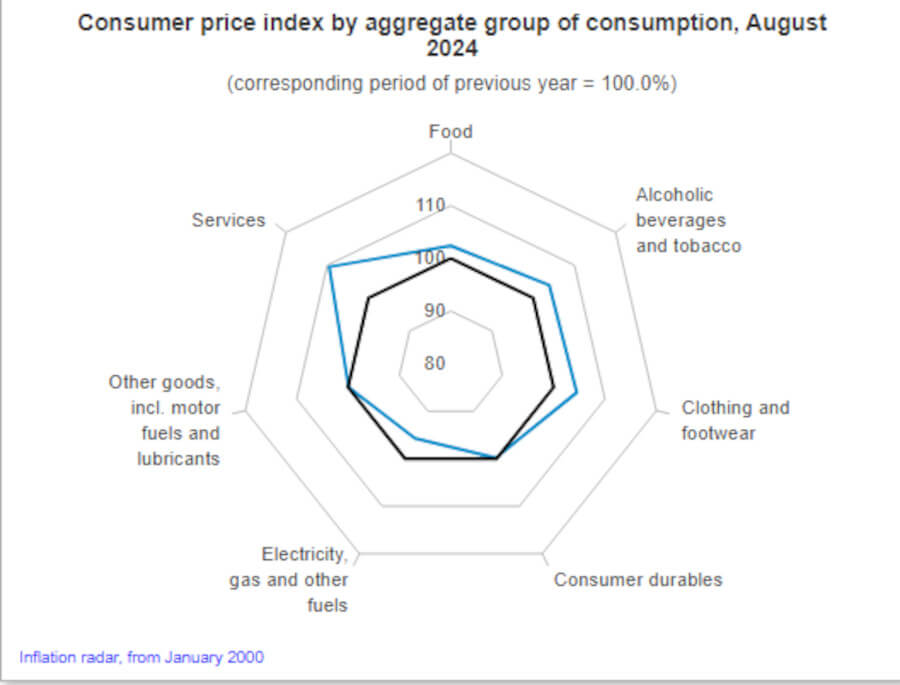

Updated: NBH Sees Inflation Slowing Further in September in Hungary

- 27 Sep 2024 6:00 AM

- finance

August's 3.4pc CPI was in line with the National Bank of Hungary's expectations, and the central bank sees inflation falling to 3.1pc in September, Andras Balatoni, an NBH director said.

Top Performance for Environmental, Social & Governance: CIB Bank Awarded ‘Best Bank for ESG’ in Hungary

- 8 Aug 2024 7:05 AM

- https://bbj.hu/

- finance

CIB Bank has been awarded the "Best Bank for ESG" accolade by Euromoney financial magazine, recognizing its leadership in sustainable banking and bank insurance services in Hungary.

Here's Why Base Rate to Remain High in Hungary at 13%

- 1 Mar 2023 6:49 AM

- hungarymatters.hu

- finance

Hungarian rate-setters decided to leave the base rate unchanged at 13% at a regular policy meeting on Tuesday.

13% Base Rate Kept on Hold in Hungary

- 25 Jan 2023 10:29 AM

- hungarymatters.hu

- finance

Hungarian rate-setters decided to keep the base rate on hold at 13% at a regular policy meeting on Tuesday, the first such meeting this year.

Watch: EC Says Reforms by Hungary Not Enough to Get All Withheld EU Funds

- 1 Dec 2022 6:38 AM

- hungarymatters.hu

- finance

The European Commission believes the reforms undertaken by Budapest so far to ensure EU money is not misused did not go far enough.

Central Bank Keeps Base Rate at 13%

- 23 Nov 2022 8:55 AM

- hungarymatters.hu

- finance

Hungarian rate-setters left the base rate on hold at 13% at a regular policy meeting. The Council also decided on Tuesday to keep the central bank’s O/N deposit rate at 12.50% and the O/N collateralised loan rate at 25%.

Base Rate Raised Again by Central Bank in Hungary - Extraordinary Measures Explained

- 27 Jul 2022 11:35 AM

- hungarymatters.hu

- finance

NBH rate-setters raised the base rate by 100 basis points to 10.75% this Tuesday. The Monetary Council had raised the base rate by 200 basis points to 9.75% just two weeks earlier, taking the extraordinary measure at a non-rate-setting meeting to keep the key rate in tandem with the one-week deposit rate.