41 result(s) for changes in tax return

Accounting Services From Colling Accounting In Budapest

- 10 Jul 2013 6:00 AM

- specials

Colling Ltd has been providing full service of accounting, payroll, tax advisory and cafeteria services since 1992 to Hungarian and international partners as well. Within the framework of our accounting services, Colling can perform the followings:

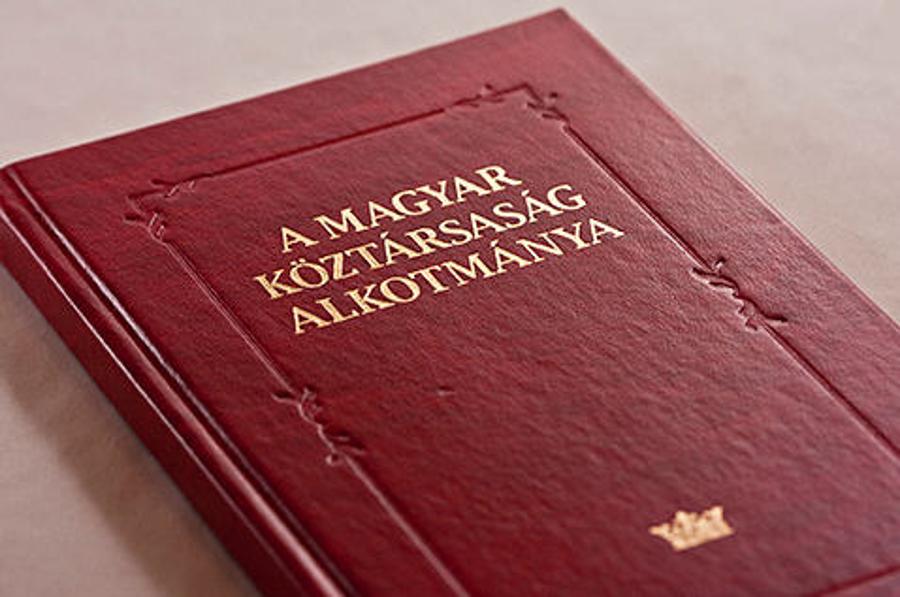

Xpat Opinion: Constitutional Renewal Must Be Done By Hungarians For Hungarians

- 13 Jul 2012 1:00 AM

- current affairs

A conversation between two consitutional legal scholars: Kim Lane Scheppele, Princeton University and Gábor Halmai, ELTE Budapest and Princeton University.

Colling Accounting: Personal Income Tax Changes In 2012

- 2 May 2012 6:56 AM

- specials

"Tax base top-up According to the new rules in the case of incomes below the annual gross income limit of HUF 2,424,000 the annual tax rate will remain 16%, i.e. the tax base top-up (27%) is not to be considered for the purpose of tax base. In the case of incomes above that (gross HUF 202,000 / month) the 16% personal income tax advance for the part above the limit shall be calculated for a ...

Colling Accounting: Changes In Hungarian Tax Legislation 2011

- 17 Dec 2010 2:00 AM

- specials

"2011 is the year of tax legislation changes, as tax laws this year have changed even more frequently than in previous years. Instead of – sometimes necessary, but often inspired by sudden ideas and consequently brush-fire nature (often surviving only for one year) – austerity measures taken in previous years, we can now witness the fundaments of an entirely different system taking form, which ...

Windfall Taxes On Energy, Telecoms And Retail In Hungary

- 14 Oct 2010 2:00 AM

- business

"Prime Minister Viktor Orbán yesterday announced new taxes to be imposed on Hungary’s telecoms, energy and large retail companies this year and in the next two years under legislation to be submitted to Parliament on Monday.

Accounting Services From Colling Accounting In Budapest

- 10 Jul 2013 6:00 AM

- specials

Colling Ltd has been providing full service of accounting, payroll, tax advisory and cafeteria services since 1992 to Hungarian and international partners as well. Within the framework of our accounting services, Colling can perform the followings:

Xpat Opinion: Constitutional Renewal Must Be Done By Hungarians For Hungarians

- 13 Jul 2012 1:00 AM

- current affairs

A conversation between two consitutional legal scholars: Kim Lane Scheppele, Princeton University and Gábor Halmai, ELTE Budapest and Princeton University.

Colling Accounting: Personal Income Tax Changes In 2012

- 2 May 2012 6:56 AM

- specials

"Tax base top-up According to the new rules in the case of incomes below the annual gross income limit of HUF 2,424,000 the annual tax rate will remain 16%, i.e. the tax base top-up (27%) is not to be considered for the purpose of tax base. In the case of incomes above that (gross HUF 202,000 / month) the 16% personal income tax advance for the part above the limit shall be calculated for a ...

Colling Accounting: Changes In Hungarian Tax Legislation 2011

- 17 Dec 2010 2:00 AM

- specials

"2011 is the year of tax legislation changes, as tax laws this year have changed even more frequently than in previous years. Instead of – sometimes necessary, but often inspired by sudden ideas and consequently brush-fire nature (often surviving only for one year) – austerity measures taken in previous years, we can now witness the fundaments of an entirely different system taking form, which ...

Windfall Taxes On Energy, Telecoms And Retail In Hungary

- 14 Oct 2010 2:00 AM

- business

"Prime Minister Viktor Orbán yesterday announced new taxes to be imposed on Hungary’s telecoms, energy and large retail companies this year and in the next two years under legislation to be submitted to Parliament on Monday.