33 result(s) for flat tax in Business

Complaint by Ryanair Against HUF 300 Million Fine Rejected by Court in Hungary

- 20 Apr 2023 7:10 AM

- http://www.hatc.hu

- business

The Constitutional Court has rejected a complaint from airline Ryanair against the introduction of the extra profit tax introduced in the summer of 2022, declaring that it does not have the authority to rule on the matter.

Hungary Economy ‘Holds No Surprises’, Says Orbán

- 11 Oct 2022 5:41 AM

- hungarymatters.hu

- business

Prime Minister Viktor Orbán, addressing a forum on Hungarian-German economic ties in Berlin, said Hungary’s economy held no surprises and the government had its medium and long-term plans mapped out for each sector.

Hungarian Business Chamber Recommends Crackdown On Small Business Tax Abusers

- 18 Jun 2020 7:34 AM

- hungarymatters.hu

- business

The Hungarian Chamber of Industry and Commerce (MKIK) is recommending a number of measures to put a squeeze on unscrupulous companies that are abusing the Itemised Tax for Small Businesses (KATA), daily Magyar Nemzet said.

More Than 315,000 Companies In Hungary Opt For Small Business Tax

- 17 Jan 2019 9:10 AM

- hungarymatters.hu

- business

The number of Hungarian companies opting to pay the itemised tax for small businesses, known by its Hungarian acronym “kata”, stood over 315,000 on January 1, Finance Minister Mihály Varga said.

Legal Changes Taking Effect On 1 January In Hungary

- 2 Jan 2017 8:00 AM

- business

Hungary faces several legal changes as of Jan. 1, 2017, including a drop in the bank levy, whose upper bracket will be reduced by 3 basis points to 0.21 percent. The reduction in the tax comes as part of an agreement with the European Bank for Reconstruction and Development (EBRD).

Parliament Votes To Reduce Payroll Tax

- 13 Dec 2016 9:00 AM

- business

Parliament approved a bill that reduces the payroll tax from 27% to 22% from next year, and to 20% from 2018. The bill adjusts the healthcare contributions accordingly, reducing them from 27% to 22% for 2017. Economy Minister Mihály Varga submitted the bill to parliament earlier in December.

Hungary CPI Climbs to 1.1 pc In November

- 11 Dec 2016 6:45 AM

- business

Consumer prices in Hungary rose by an annual 1.1 percent in November, accelerating from a 1.0 percent increase in the previous month. The headline figure was slightly lower than the 1.2 percent analysts’ consensus. In a month-on-month comparison, CPI slowed to 0.1 percent from 0.6 percent in October.

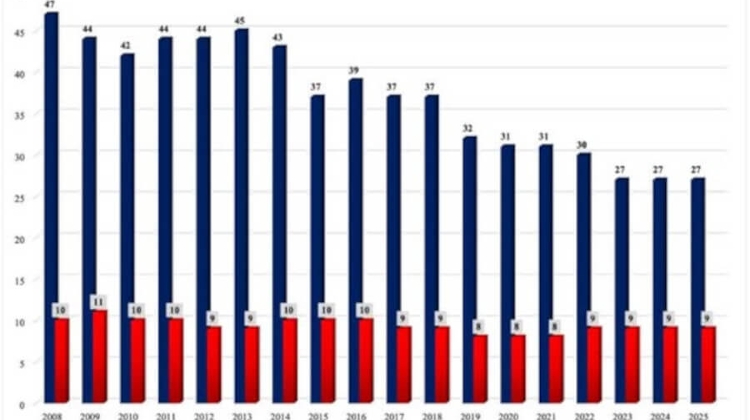

Opinion: Hungary To Cut Corporate Tax Rate To Lowest In EU

- 24 Nov 2016 2:35 AM

- business

A conservative economist welcomes PM Orbán’s announcement that Hungarian corporate tax is to be cut to the lowest in the EU. A liberal economist, on the other hand, fears that the tax cut will create disparities in the economy.

Hungary Eyes 9% Flat Corporate Tax

- 18 Nov 2016 8:00 AM

- business

Corporate tax in Hungary will be lowered to a flat 9% as of next year, Hungary’s Prime Minister Viktor Orbán announced today at the Regional Digital Summit conference in Budapest, according to Hungarian news agency MTI.

Complaint by Ryanair Against HUF 300 Million Fine Rejected by Court in Hungary

- 20 Apr 2023 7:10 AM

- http://www.hatc.hu

- business

The Constitutional Court has rejected a complaint from airline Ryanair against the introduction of the extra profit tax introduced in the summer of 2022, declaring that it does not have the authority to rule on the matter.

Hungary Economy ‘Holds No Surprises’, Says Orbán

- 11 Oct 2022 5:41 AM

- hungarymatters.hu

- business

Prime Minister Viktor Orbán, addressing a forum on Hungarian-German economic ties in Berlin, said Hungary’s economy held no surprises and the government had its medium and long-term plans mapped out for each sector.

Hungarian Business Chamber Recommends Crackdown On Small Business Tax Abusers

- 18 Jun 2020 7:34 AM

- hungarymatters.hu

- business

The Hungarian Chamber of Industry and Commerce (MKIK) is recommending a number of measures to put a squeeze on unscrupulous companies that are abusing the Itemised Tax for Small Businesses (KATA), daily Magyar Nemzet said.

More Than 315,000 Companies In Hungary Opt For Small Business Tax

- 17 Jan 2019 9:10 AM

- hungarymatters.hu

- business

The number of Hungarian companies opting to pay the itemised tax for small businesses, known by its Hungarian acronym “kata”, stood over 315,000 on January 1, Finance Minister Mihály Varga said.

Legal Changes Taking Effect On 1 January In Hungary

- 2 Jan 2017 8:00 AM

- business

Hungary faces several legal changes as of Jan. 1, 2017, including a drop in the bank levy, whose upper bracket will be reduced by 3 basis points to 0.21 percent. The reduction in the tax comes as part of an agreement with the European Bank for Reconstruction and Development (EBRD).

Parliament Votes To Reduce Payroll Tax

- 13 Dec 2016 9:00 AM

- business

Parliament approved a bill that reduces the payroll tax from 27% to 22% from next year, and to 20% from 2018. The bill adjusts the healthcare contributions accordingly, reducing them from 27% to 22% for 2017. Economy Minister Mihály Varga submitted the bill to parliament earlier in December.

Hungary CPI Climbs to 1.1 pc In November

- 11 Dec 2016 6:45 AM

- business

Consumer prices in Hungary rose by an annual 1.1 percent in November, accelerating from a 1.0 percent increase in the previous month. The headline figure was slightly lower than the 1.2 percent analysts’ consensus. In a month-on-month comparison, CPI slowed to 0.1 percent from 0.6 percent in October.

Opinion: Hungary To Cut Corporate Tax Rate To Lowest In EU

- 24 Nov 2016 2:35 AM

- business

A conservative economist welcomes PM Orbán’s announcement that Hungarian corporate tax is to be cut to the lowest in the EU. A liberal economist, on the other hand, fears that the tax cut will create disparities in the economy.

Hungary Eyes 9% Flat Corporate Tax

- 18 Nov 2016 8:00 AM

- business

Corporate tax in Hungary will be lowered to a flat 9% as of next year, Hungary’s Prime Minister Viktor Orbán announced today at the Regional Digital Summit conference in Budapest, according to Hungarian news agency MTI.