99 result(s) for tax allowance

Hungary’s Tax Package For 2014 Includes New Tax On Banks And Sugary Drinks

- 24 Oct 2013 9:00 AM

- business

While 250 000 new families are happy with the extended family tax credits and small businesses are satisfied with the support they will receive, banks are not dancing with joy at the introduction of new tax laws for 2014. The Hungarian government submitted next year’s tax package to the Parliament last week, which includes just a few drastic, but several minor changes.

Phantom Art Groups Gained Hundreds Of Millions From Tax Allowance In Hungary

- 7 Oct 2013 1:00 AM

- current affairs

Not only sports federations or teams can be granted by the tax allowance system (TAO): a law-amendment allowed companies to support ’spectacular team sports’ from their charges instead of paying it to the state. According to the regulations, performing-art organisations can be granted as well and as Atlatszo.hu’s investigation has shown several companies are seem to be granted with hundreds of ...

Hungary's PM: Banks Must Amend Foreign Currency Mortgage Contracts

- 9 Sep 2013 9:00 AM

- property

Prime Minister Viktor Orbán considers amending foreign exchange mortgage contracts a moral responsibility for banks. In public Kossuth radio’s morning show 180 minutes, he also highlighted that the recent economic data are signs of Hungary’s recovery.

Hungary’s Economy Makes Positive U-Turn

- 21 Aug 2013 9:00 AM

- business

As a result of the Government measures introduced over the past three years Hungary has begun a period of sustainable economic growth. With the early repayment of the IMF loan, Hungary has proven to be an economically independent country which can finance itself from the markets. This achievement is even more remarkable given the fact that during this process Hungary has succeeded in emerging ...

Hungary's Gov To Remove Foreign-Currency Denominated Mortgages From Market

- 29 Jul 2013 9:00 AM

- property

The Government has given the economy minister, Mihály Varga, a mandate to remove foreign-currency denominated mortgages from the Hungarian financial system, Prime Minister Viktor Orbán said in his regular morning interview on Kossuth public radio, adding that a solution is required, which does not endanger the financial system.

Hungary To Repay IMF Loan By 2014 At The Latest

- 17 Jun 2013 9:00 AM

- current affairs

Hungary is determined to repay the IMF loan taken out in 2008 until 2014 at the latest; Minister for National Economy Mihály Varga said in Budapest at a presentation held within the framework of the Fidesz programme entitled Hungary is Doing Better.

Hungarian Ministers Pay Low Income Tax

- 7 Jun 2013 9:00 AM

- current affairs

Some cabinet ministers enjoy income tax payments below the flat 16% rate, Napi Gazdaság reports, citing data from the government website. The primary reason is the tax break granted to those with large families.

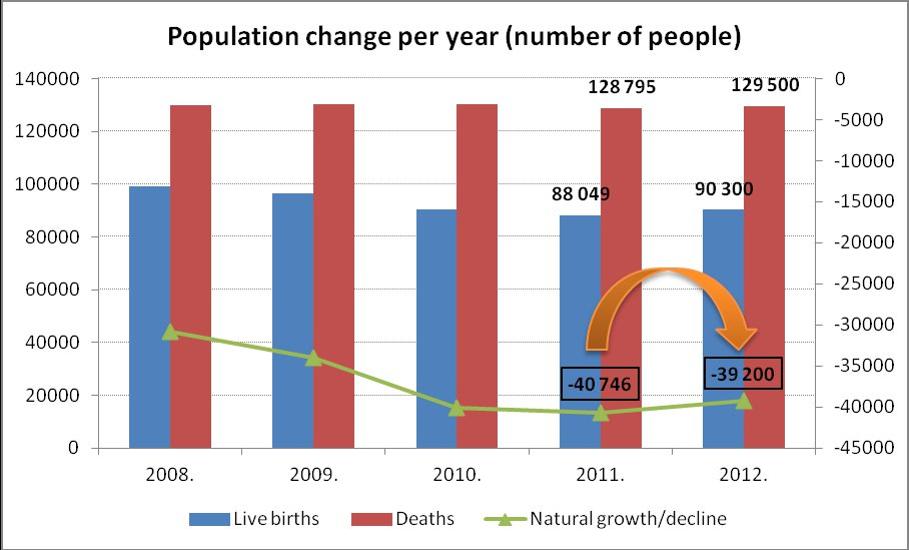

Population Decline Slowing In Hungary, Less Abortions

- 12 Mar 2013 8:00 AM

- current affairs

The pace of population decline moderated in 2012 compared to the previous year, as the number of births increased significantly last year. The fact that 2251 more children were born signals that the family-friendly policy of the Government has been effective; family tax allowances introduced as of January 2011 appear to have succeeded in their objective added the Government source.

More Money Will Be Allocated To Culture In Hungary In 2013

- 11 Jan 2013 8:00 AM

- community & culture

Public spending on culture will increase significantly in 2013, Minister of State for Culture László L. Simon announced on 10 January. The politician underlined that the State Secretariat for Culture will have an increased budget of HUF 35 billion this year. Furthermore, other ministries will also have cultural contributions from their own budget; the Ministry of Interior will have 25 billion ...

Hungary’s Tax Package For 2014 Includes New Tax On Banks And Sugary Drinks

- 24 Oct 2013 9:00 AM

- business

While 250 000 new families are happy with the extended family tax credits and small businesses are satisfied with the support they will receive, banks are not dancing with joy at the introduction of new tax laws for 2014. The Hungarian government submitted next year’s tax package to the Parliament last week, which includes just a few drastic, but several minor changes.

Phantom Art Groups Gained Hundreds Of Millions From Tax Allowance In Hungary

- 7 Oct 2013 1:00 AM

- current affairs

Not only sports federations or teams can be granted by the tax allowance system (TAO): a law-amendment allowed companies to support ’spectacular team sports’ from their charges instead of paying it to the state. According to the regulations, performing-art organisations can be granted as well and as Atlatszo.hu’s investigation has shown several companies are seem to be granted with hundreds of ...

Hungary's PM: Banks Must Amend Foreign Currency Mortgage Contracts

- 9 Sep 2013 9:00 AM

- property

Prime Minister Viktor Orbán considers amending foreign exchange mortgage contracts a moral responsibility for banks. In public Kossuth radio’s morning show 180 minutes, he also highlighted that the recent economic data are signs of Hungary’s recovery.

Hungary’s Economy Makes Positive U-Turn

- 21 Aug 2013 9:00 AM

- business

As a result of the Government measures introduced over the past three years Hungary has begun a period of sustainable economic growth. With the early repayment of the IMF loan, Hungary has proven to be an economically independent country which can finance itself from the markets. This achievement is even more remarkable given the fact that during this process Hungary has succeeded in emerging ...

Hungary's Gov To Remove Foreign-Currency Denominated Mortgages From Market

- 29 Jul 2013 9:00 AM

- property

The Government has given the economy minister, Mihály Varga, a mandate to remove foreign-currency denominated mortgages from the Hungarian financial system, Prime Minister Viktor Orbán said in his regular morning interview on Kossuth public radio, adding that a solution is required, which does not endanger the financial system.

Hungary To Repay IMF Loan By 2014 At The Latest

- 17 Jun 2013 9:00 AM

- current affairs

Hungary is determined to repay the IMF loan taken out in 2008 until 2014 at the latest; Minister for National Economy Mihály Varga said in Budapest at a presentation held within the framework of the Fidesz programme entitled Hungary is Doing Better.

Hungarian Ministers Pay Low Income Tax

- 7 Jun 2013 9:00 AM

- current affairs

Some cabinet ministers enjoy income tax payments below the flat 16% rate, Napi Gazdaság reports, citing data from the government website. The primary reason is the tax break granted to those with large families.

Population Decline Slowing In Hungary, Less Abortions

- 12 Mar 2013 8:00 AM

- current affairs

The pace of population decline moderated in 2012 compared to the previous year, as the number of births increased significantly last year. The fact that 2251 more children were born signals that the family-friendly policy of the Government has been effective; family tax allowances introduced as of January 2011 appear to have succeeded in their objective added the Government source.

More Money Will Be Allocated To Culture In Hungary In 2013

- 11 Jan 2013 8:00 AM

- community & culture

Public spending on culture will increase significantly in 2013, Minister of State for Culture László L. Simon announced on 10 January. The politician underlined that the State Secretariat for Culture will have an increased budget of HUF 35 billion this year. Furthermore, other ministries will also have cultural contributions from their own budget; the Ministry of Interior will have 25 billion ...