196 result(s) for small business tax

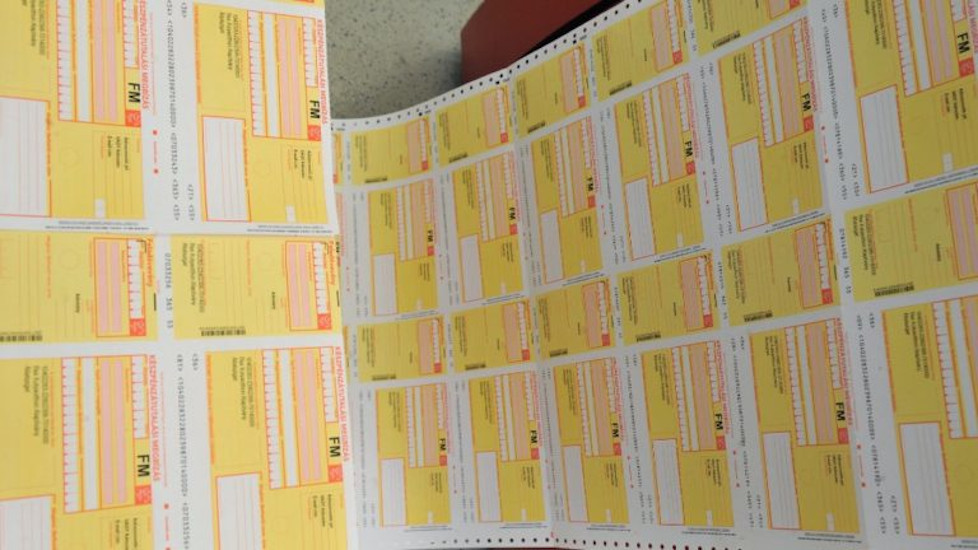

KATA: Controversial Bill Submitted Restricting Small Business Tax to Sole Proprietors in Hungary

- 12 Jul 2022 11:54 AM

- hungarymatters.hu

- finance

The government has submitted a bill to lawmakers that would restrict the Itemised Tax for Small Businesses (KATA) to sole proprietors.

Petition Drive Against Gov't Plan to Scrap KATA Tax Launched by Opposition Party DK

- 30 May 2022 7:38 AM

- hungarymatters.hu

- finance

The Democratic Coalition (DK) will launch a petition drive in protest against plans by the government to scrap the preferential Itemised Tax for Small Businesses (KATA), the opposition party’s parliamentary group spokeswoman said on Sunday.

Windfall Taxes ‘Not Expected to Burden Consumers’ in Hungary, Claims Minister

- 27 May 2022 9:31 AM

- hungarymatters.hu

- current affairs

The new windfall taxes imposed on banks, insurers, retail chains, energy companies, telcos and airlines are not expected to burden consumers because the measure only taxes companies’ extra profits, Márton Nagy, the new minister for economic development, told a press briefing on Thursday.

See What Happened @ St. George's Day Bash in Budapest - 'Smashing Success' say Guests

- 6 May 2022 4:23 PM

- community & culture

The first large scale St. George's Day event in Budapest raised over HUF 2 million for charity, entertaining a full house with a feast of English music, a funny take on a Shakespeare piece, and a great variety of refreshments, games, prizes, + dancing.

Invitation: St. George's Event, Corinthia Ballroom, 30 April: ‘A Feast of English Music’

- 30 Mar 2022 11:11 AM

- specials

You’re warmly invited to meet up with the English community in Hungary - including the British Ambassador - at this special St. George's Day event in Budapest, held this year to mark the Platinum Jubilee of Her Majesty Queen Elizabeth II.

Hungary to Cut Taxes by HUF 1,500 Billion Next Year, Says Finance Minister

- 23 Dec 2021 9:18 AM

- hungarymatters.hu

- finance

The government will cut taxes by 1,500 billion forints (EUR 4.1bn) in 2022, a video posted on Wednesday on Finance Minister Mihály Varga’s Facebook page showed.

PM Orbán: Vaccination of 5-12 Year Olds to be Assessed

- 21 Nov 2021 8:37 AM

- hungarymatters.hu

- health & wellness

Orbán said that health experts were expected to determine “around December” if children between 5-12 could be inoculated and in case of a positive answer parents would have an opportunity to vaccinate their children.

Those Who Refuse Vaccine Put Peoples Lives at Risk, Says Hungarian PM's Chief of Staff

- 19 Nov 2021 6:58 AM

- hungarymatters.hu

- health & wellness

People who refused to be vaccinated put the health and lives of others at risk, Gergely Gulyás, the prime minister’s chief of staff, said, adding that the government had been forced to make mask-wearing compulsory for this reason.

Hungarian Opinion: Soaring Energy Prices

- 19 Oct 2021 7:02 AM

- http://www.budapost.eu

- shopping

As energy prices skyrocket, a left-wing commentator calls on the government to lower taxes on gasoline. A conservative economist thinks that rising energy prices impact Hungary less than many other EU countries, thanks to the diversification of energy supply.

KATA: Controversial Bill Submitted Restricting Small Business Tax to Sole Proprietors in Hungary

- 12 Jul 2022 11:54 AM

- hungarymatters.hu

- finance

The government has submitted a bill to lawmakers that would restrict the Itemised Tax for Small Businesses (KATA) to sole proprietors.

Petition Drive Against Gov't Plan to Scrap KATA Tax Launched by Opposition Party DK

- 30 May 2022 7:38 AM

- hungarymatters.hu

- finance

The Democratic Coalition (DK) will launch a petition drive in protest against plans by the government to scrap the preferential Itemised Tax for Small Businesses (KATA), the opposition party’s parliamentary group spokeswoman said on Sunday.

Windfall Taxes ‘Not Expected to Burden Consumers’ in Hungary, Claims Minister

- 27 May 2022 9:31 AM

- hungarymatters.hu

- current affairs

The new windfall taxes imposed on banks, insurers, retail chains, energy companies, telcos and airlines are not expected to burden consumers because the measure only taxes companies’ extra profits, Márton Nagy, the new minister for economic development, told a press briefing on Thursday.

See What Happened @ St. George's Day Bash in Budapest - 'Smashing Success' say Guests

- 6 May 2022 4:23 PM

- community & culture

The first large scale St. George's Day event in Budapest raised over HUF 2 million for charity, entertaining a full house with a feast of English music, a funny take on a Shakespeare piece, and a great variety of refreshments, games, prizes, + dancing.

Invitation: St. George's Event, Corinthia Ballroom, 30 April: ‘A Feast of English Music’

- 30 Mar 2022 11:11 AM

- specials

You’re warmly invited to meet up with the English community in Hungary - including the British Ambassador - at this special St. George's Day event in Budapest, held this year to mark the Platinum Jubilee of Her Majesty Queen Elizabeth II.

Hungary to Cut Taxes by HUF 1,500 Billion Next Year, Says Finance Minister

- 23 Dec 2021 9:18 AM

- hungarymatters.hu

- finance

The government will cut taxes by 1,500 billion forints (EUR 4.1bn) in 2022, a video posted on Wednesday on Finance Minister Mihály Varga’s Facebook page showed.

PM Orbán: Vaccination of 5-12 Year Olds to be Assessed

- 21 Nov 2021 8:37 AM

- hungarymatters.hu

- health & wellness

Orbán said that health experts were expected to determine “around December” if children between 5-12 could be inoculated and in case of a positive answer parents would have an opportunity to vaccinate their children.

Those Who Refuse Vaccine Put Peoples Lives at Risk, Says Hungarian PM's Chief of Staff

- 19 Nov 2021 6:58 AM

- hungarymatters.hu

- health & wellness

People who refused to be vaccinated put the health and lives of others at risk, Gergely Gulyás, the prime minister’s chief of staff, said, adding that the government had been forced to make mask-wearing compulsory for this reason.

Hungarian Opinion: Soaring Energy Prices

- 19 Oct 2021 7:02 AM

- http://www.budapost.eu

- shopping

As energy prices skyrocket, a left-wing commentator calls on the government to lower taxes on gasoline. A conservative economist thinks that rising energy prices impact Hungary less than many other EU countries, thanks to the diversification of energy supply.